- October 28, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – The Slide in Business Spending Growth May Be Bottoming

Microsoft’s strong quarterly earnings report and related commentary regarding IT spending were well received by the equity markets last week. The company posted quarterly financial results that exceeded analyst expectations. But perhaps what captivated the broader market’s attention more than the results was management’s outlook for IT (information technology) spending for next year and beyond. The company reiterated that IT budgets look to be intact and that the spending environment remains favorable, driven primarily by cloud adoption and transition. Microsoft’s positive commentary followed Taiwan Semiconductor’s announcement that the company was raising its 2019 capital spending guidance by $4 billion, to ~$14 billion, on the back of stronger 5G deployment related demand. Results from Intel and Amazon echoed the robust tech spending environment.

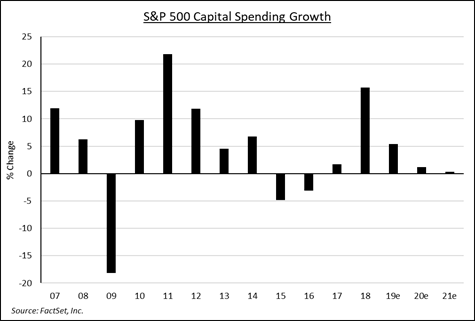

Those reports, and others, are good news for technology stocks, and for the broader market, among growing fears that IT spending would decelerate into 2020. According to recent estimates from Gartner, IT spending is now expected to grow 3.7% in 2020, after experiencing a flat year in 2019. But broadly, capital spending growth continues to decelerate. Capex growth among S&P 500 companies is expected to slow to 5.4% in 2019 and 1.2% in 2020. Technology spending is an important component of business investment’s contribution to GDP, but so are heavyweight measures like non-residential and residential construction. Those categories have shown softness in recent months but could re-accelerate if corporate managements gain clarity on the outlook for the economy and trade.

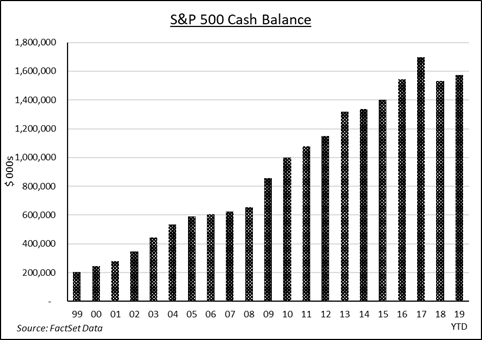

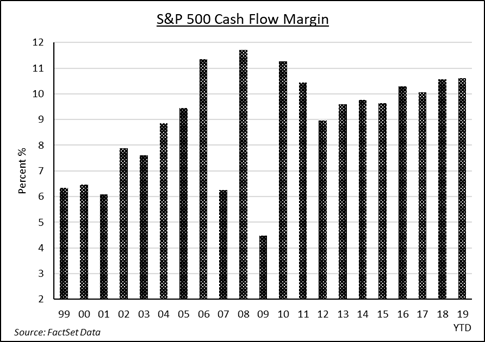

According to the Federal Reserve’s Philly Fed Survey, one out of every six companies in the region plans to reduce capital spending next year because of trade uncertainty. 17.5% of respondents to a special questionnaire in the survey claimed that tariffs and trade were the impetus for lower spending. But in the hyper-competitive business environment in which most companies operate, capital spending can’t be deferred for long. Customer needs and demands often drive the pursuit of business efficiency and companies that don’t invest in productivity fall quickly behind and lose competitiveness and relevancy. At mid-year, S&P Index constituents continued to hold elevated levels of cash, and cash flow margins remain high, so there is ample business capital available to put to work. Some form of a trade deal between the U.S. and China or competitive forces could be the catalyst for the deployment of that capital and reverse the deceleration in capex growth. Since business investment accounts for ~18% of U.S. GDP, an uptick would be a boon to the U.S. economy and would likely be well received by the equity markets. Leaders in the software, automation, robotics, and construction materials industry groups would be likely beneficiaries.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.