THE FIRM

C.J. Lawrence, an boutique investment management manager firm based in New York City with a long-standing reputation for serving high-net-worth clients and institutions, is now a division of Apollon Wealth Management. With a legacy dating back to 1864, C.J. Lawrence has built a reputation for proprietary research, disciplined portfolio management and a highly personalized approach to wealth management.

On February 24th 2025 CJL was acquired by Apollon Wealth Management, a fast growing South Carolina based wealth management firmer with 90+ advisors, in 40+ offices throughout the US, and approximately $10 billion assets under supervision over $8 billion in assets under management.

Investment Advisors

“Investment management is our core competency.”

With more than 160 years of combined investment experience, our investment advisors monitor for changes in global markets and attempt to identify longer term investment trends.

Analytical rigor and experienced investment disciplines are the foundation of our account management process.

From analysis to implementation, the firm’s portfolio managers serve as your trusted investment managers and advisors. This combined approach is what we believe sets us apart.

THOUGHT LEADERSHIP

CJL’s legacy is deeply rooted in proprietary research. The firm continues to publish regular reports on portfolio strategy, the economy, and markets. These reports are made available to our clients and have historically been quoted in the financial press. Regular market updates in video form are published on C.J. Lawrence’s YouTube channel. These videos and their transcripts can also be found on our website.

EQUITY PHILOSOPHY & PROCESS

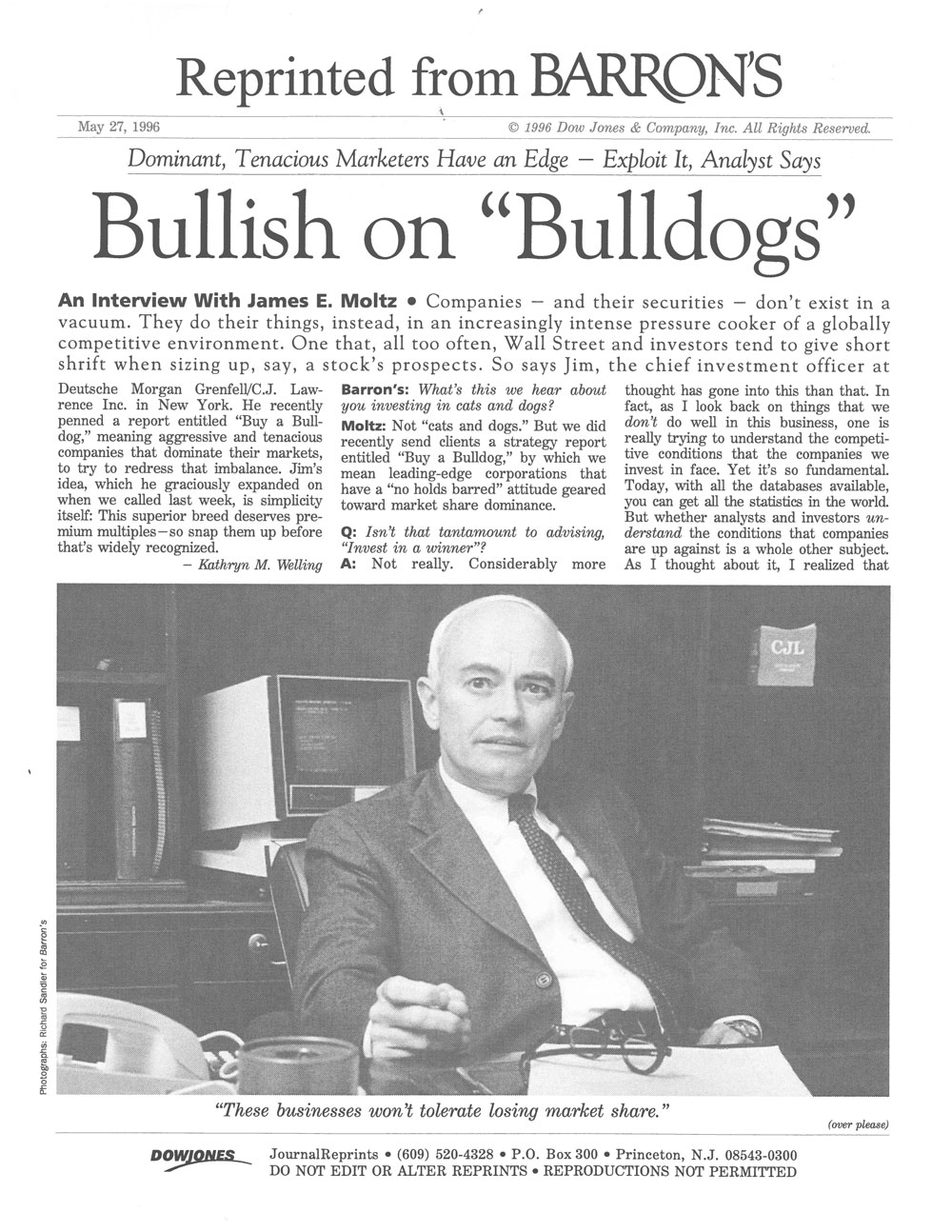

Over the past 25 years CJL’s portfolio managers have applied a qualitative discipline to establish a buy-universe of no more than 200 stocks of companies that embody what CJL calls Bulldog characteristics. We continuously actively measure and review our target stock universe and consider changes in the macro and micro-outlook. Our selection process generates a portfolio of between 30 and 40 stocks which we believe have strong potential for long-term price appreciation. Our longer-term investment horizon typically results in relatively low turnover compared to other active managers.

Bulldogs are companies that are intensely focused on taking market share in growing sectors. These companies dominate or disrupt their competition through a combination of financial strength, innovation, economies of scale, product or service differentiation, and management talent.

Our buy‐universe is continually measured by our valuation model and ranked by total return over a 3‐year period. Stock selection is subject to price/value standards measured against the future return of the market.

A diversified portfolio of 30 to 40 stocks is composed. Annual portfolio turnover tends to be low. Positions are eliminated or reduced if their preeminent competitive position erodes or when expected returns become modest compared to other stocks in our universe.

Our Bulldog‐equity portfolios are also available in conjunction with an allocation into fixed income.

CLIENT SERVICE & CUSTODY

C.J. Lawrence’s experienced client services professionals provide a high degree of service to a limited number of high net worth clients, family offices and institutions.

Our portfolio management system allows for customized reporting.

CJL infaces interfaces with most multiple custodians but uses Fidelity as its default custodian at no additional cost to clients.

For institutional clients, CJL is an approved manager on the Envestnet and Orion platforms.

Advisors Asset Management (AAM) sponsors CJL’s UIT strategies, which are offered through most multiple global investment and independent brokerage firms.

HISTORY

April 2024 – CJL’s Bulldog Portfolio UIT sponsored by AAM surpasses $2 billion in sales

2024

June 2023 – CJL awarded Top Guns distinction by Informa Financial Intelligence’s PSN manager database for Q4-2022

2023

December 2022 – PSN Top Guns names CJL on its List of Best Performing Strategies for 3Q-2022

2022

September 2022 – PSN Top Guns names CJL on its List of Best Performing Strategies for 2Q-2022

2022

April 2022 – CJL Awarded Top Guns by Informa Financial Intelligence for 4Q-2021

2022

C.J. Lawrence launches a new website and its first corporate video

2022

December 2021 – CJL Awarded Top Guns by Informa Financial Intelligence for its Bulldog-Equity Strategy

2021

October 2021 – CJL’s CEO, Bernhard Koepp interviewed by Basile Marin in French Forbes – “Comment le secteur de la gestion d’actifs réagit-il pour faire du Coronavirus une force ?”

2021

February 23, 2021 – Informa Financial Intelligence names CJL as a Top Guns Manager for its CJL Balanced and CJL Equity Strategies

2021

December 2020 – Informa Financial Solutions names CJL as a Top Guns Manager for its CJL Balanced and CJL Equity Strategies

2020

May 2020 – CJL’s Bulldog Portfolio UIT sponsored by AAM surpasses $1 billion in sales

2020

May 15, 2020 – CJL Strategist, Terry Gardner’s video including his “Tilted-V” market recovery forecast becomes the most viewed CJL YouTube video.

2020

April 2020 – CJL Launches its COVID-19 Campaign to Support Long Islanders

2020

April 2020 – Terry Gardner joins Yahoo Finance’s Alexis Christoforous and Brian Sozzi to discuss how the Coronavirus is impacting markets

2020

2020 – CJL expands to new office in Mid-Town Manhattan at 1330 Avenue of the Americas

2020

September 2019 – Investment Solutions names C.J. Lawrence as a Top Guns Manager for its CJL Balanced Strategy for 2Q-2019

2019

May 2019 – CJL Launches its YouTube Channel

2019

December 16, 2018 – CJL named Top Guns Manager for its Balanced Product for 3Q-2018 and is mentioned in Benzinga

2018

October 2018 – At the 2018 AAM Summit in Chicago, CJL’s CEO, Bernhard Koepp, ranks global digital transformation as the most significant growth opportunity for large cap investors

2018

June 2018 – Informa Investment Solutions recognizes CJL’s Bulldog-Equity Strategy as Top Guns Manager for 1Q-2018

2018

January 23, 2018 – CJL hosts its first webinar

2018

October 2017 – CJL Donates to Neediest Victims of Hurricane Maria in Puerto Rico

2017

September 2017 – CJL UIT Products Surpass $1B in Sales at AAM

2017

Former vice Chair of CJL, Charly Maxwell, shares his thoughts on the global energy markets in his special report, The Road for Nadir to Zenith Keep Existing Report

2015

Former Vice Chair of C.J. Lawrence, Charley Maxwell, shares his thoughts on the global energy markets in his special report, The Road from Nadir to Zenith.

2016

Informa Investment Solutions recognizes CJL as Top Guns Manager for 4Q-2015

2015

CJL Recognized as first time Top Guns Manager by Informa Investment Solutions, with continued recognition to the present

2015

March 2015 CJL partners with AAM

2015

Terry Gardner rejoins CJL as a portfolio manager & strategist

2015

Jim Moltz, Bruce Benedict, Bernhard Koepp relaunch Cyrus J. Lawrence

2014

ISI Inc. research broker/dealer unit merges with Evercore

2014

Jim Moltz, Bruce Benedict & Bernhard Koepp found the equity oriented account management business at ISI Inc.

1999

Barron's publishes Jim Moltz article "Bullish on Bulldogs," a widely followed strategy investing in market share dominant companies

1996

Ed Hyman forms ISI Inc.

1991

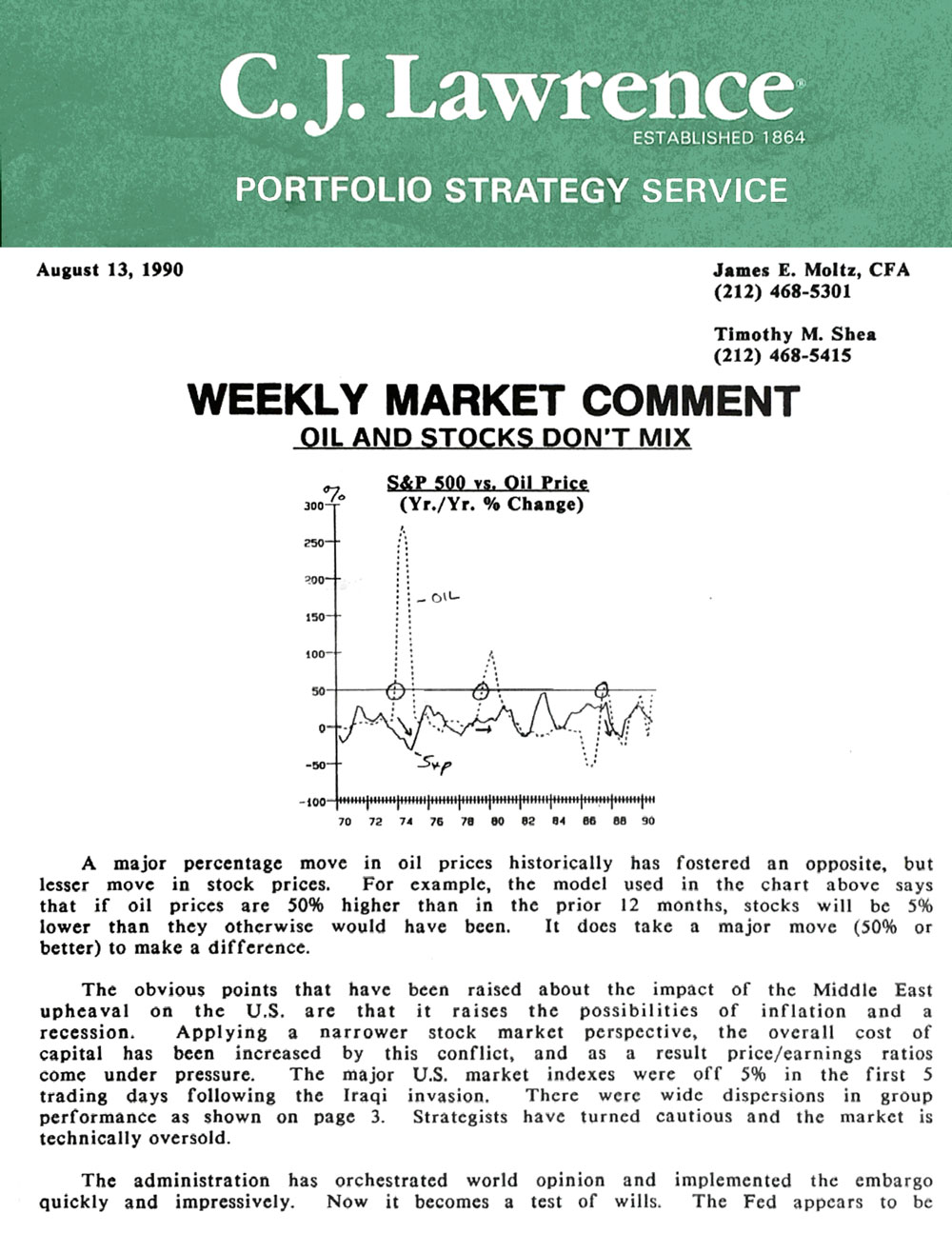

C.J. Lawrence Weekly Market Comment - Oil and Stocks Don't Mix

1990

Deutsche Bank AG acquires Morgan Grenfell / Cyrus J. Lawrence

1989

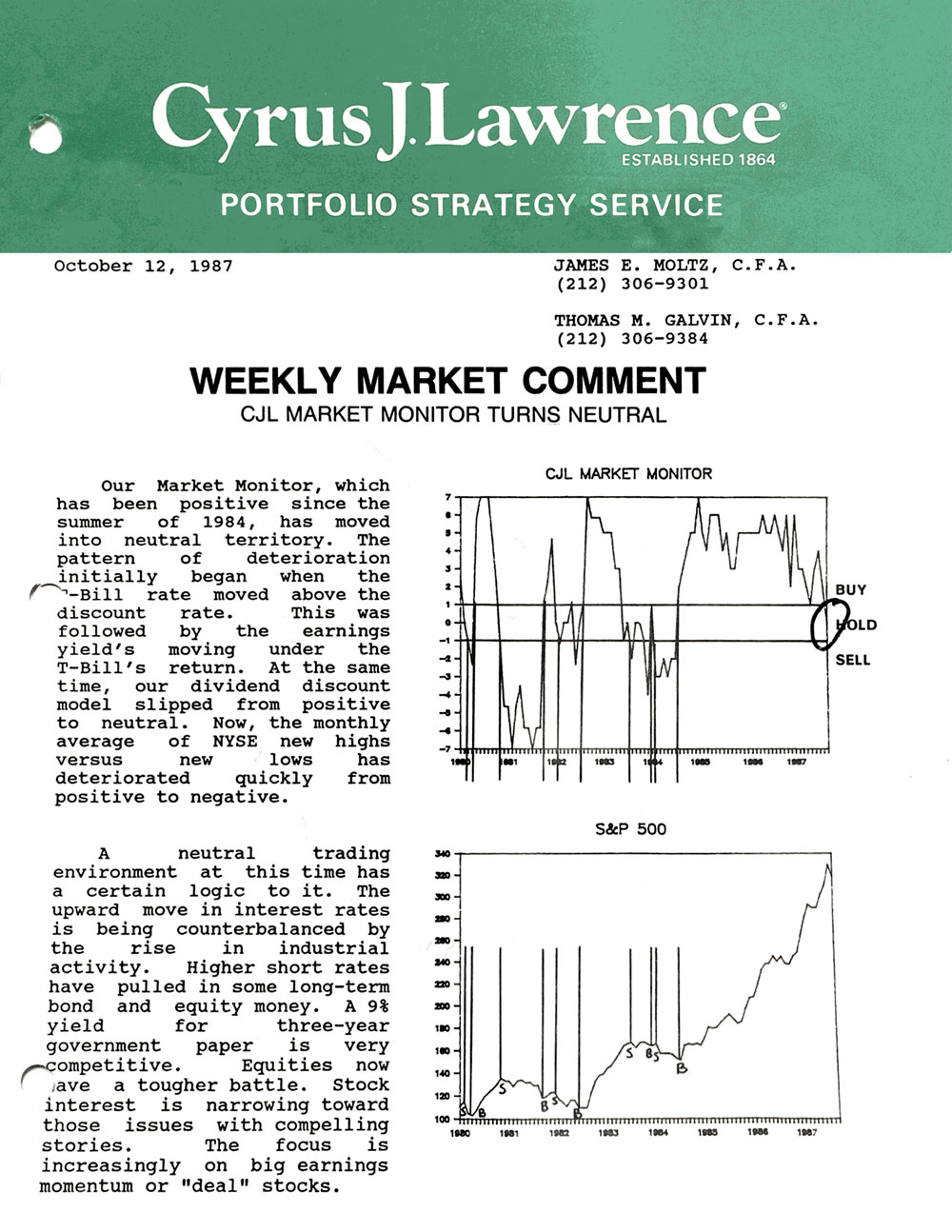

C.J. Lawrence Weekly Market Comment - CJL Market Monitor Turns Neutral

1987

Morgan Grenfell Group acquires Cyrus J. Lawrence

1986

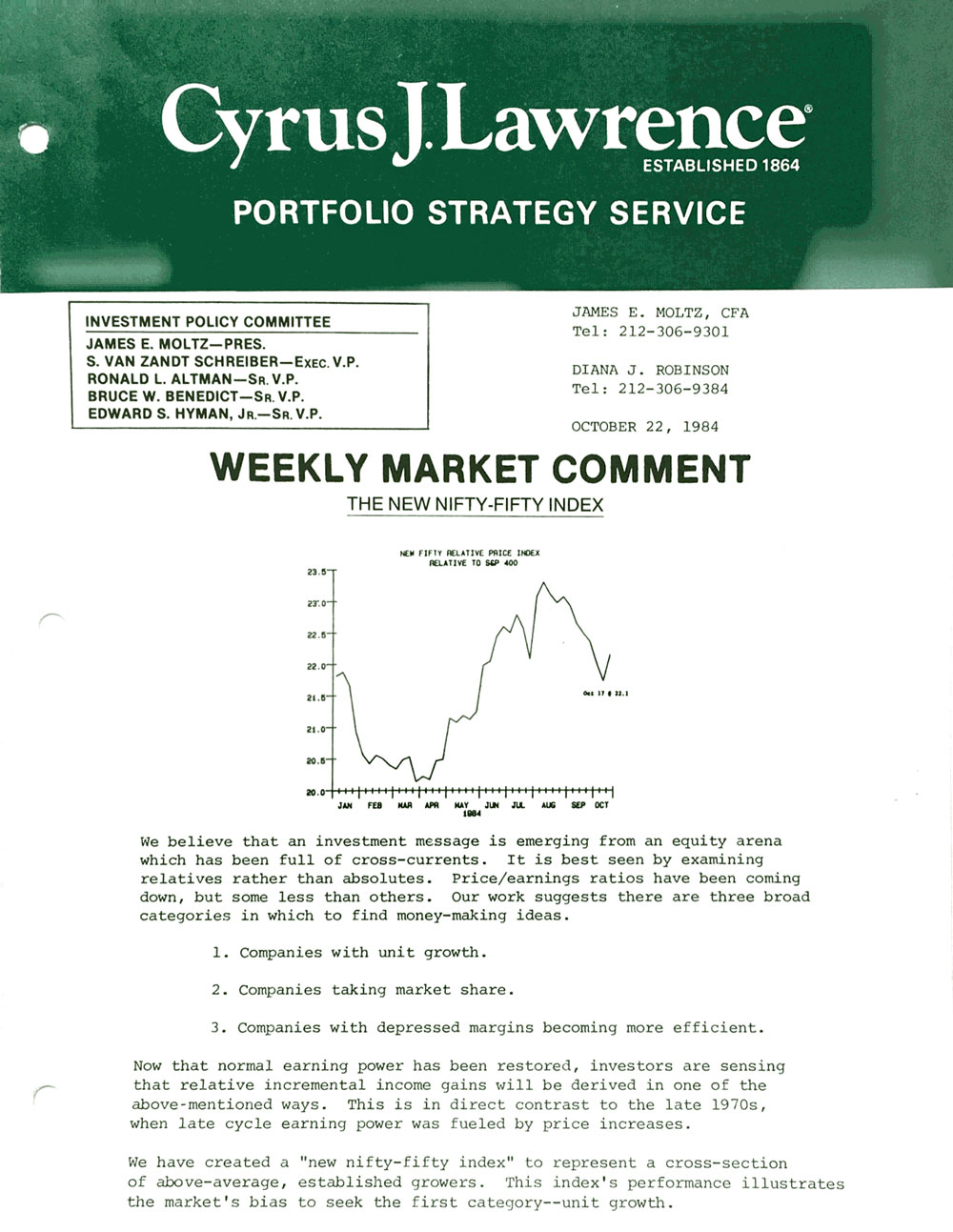

C.J. Lawrence Weekly Market Comment - The New Nifty-fifty Index

1984

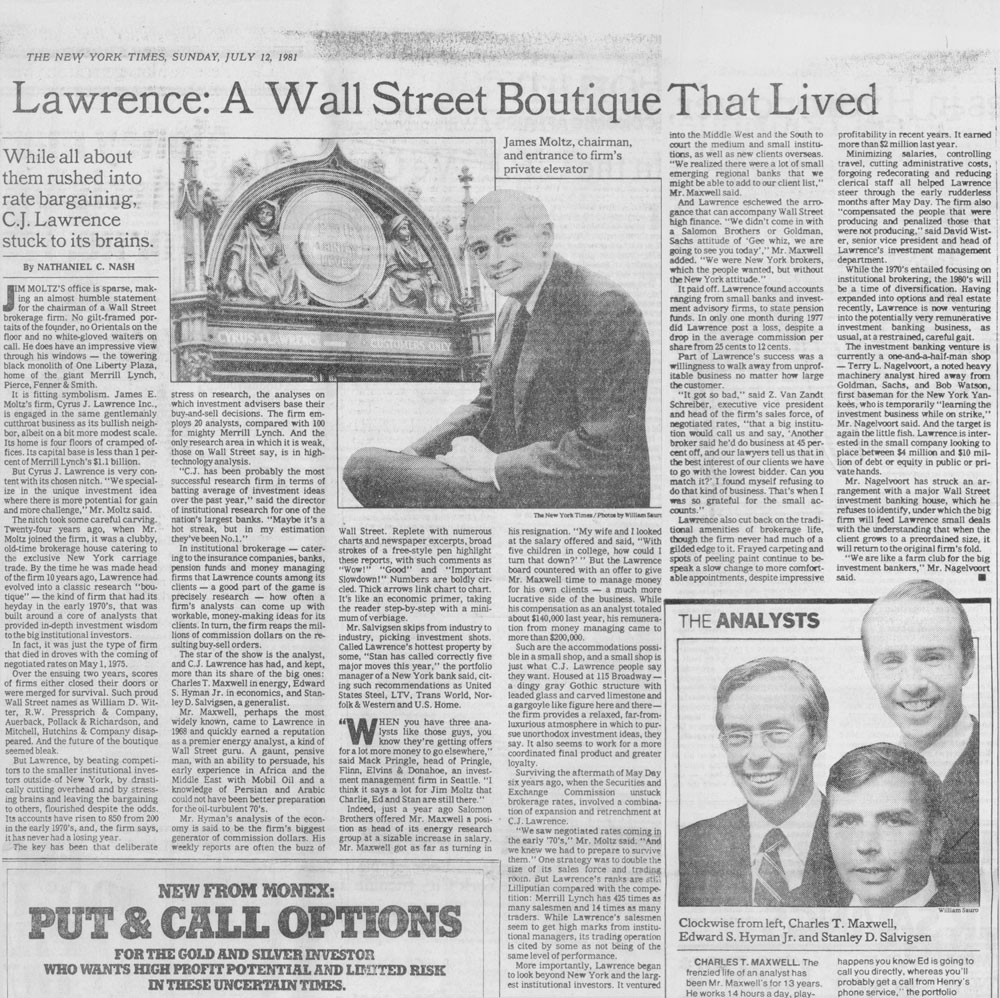

New York Times publishes profile - Lawrence: "A Wall Street Boutique That Lived"

1981

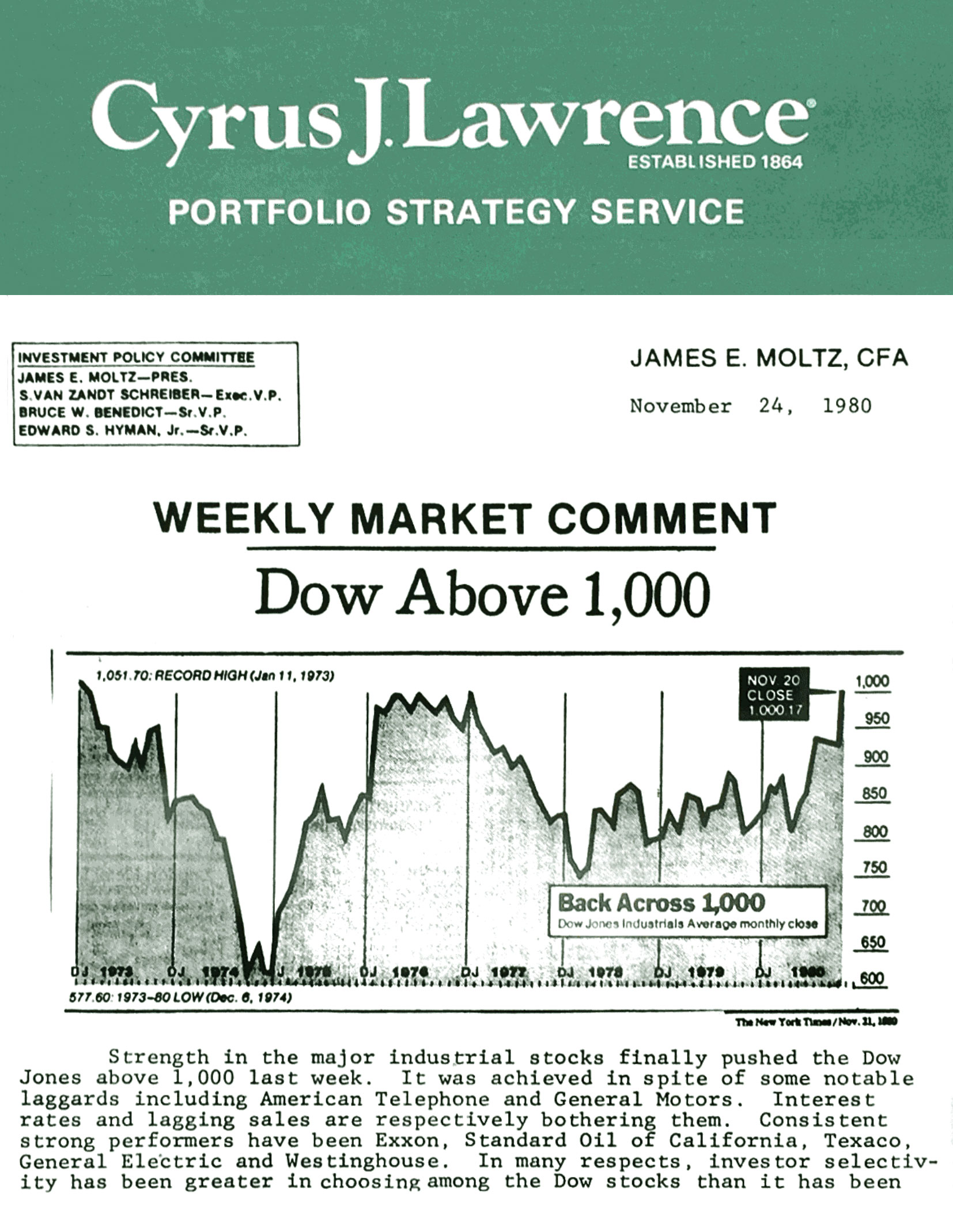

C.J. Lawrence Weekly Market Comment - Dow Above 1,000

1980

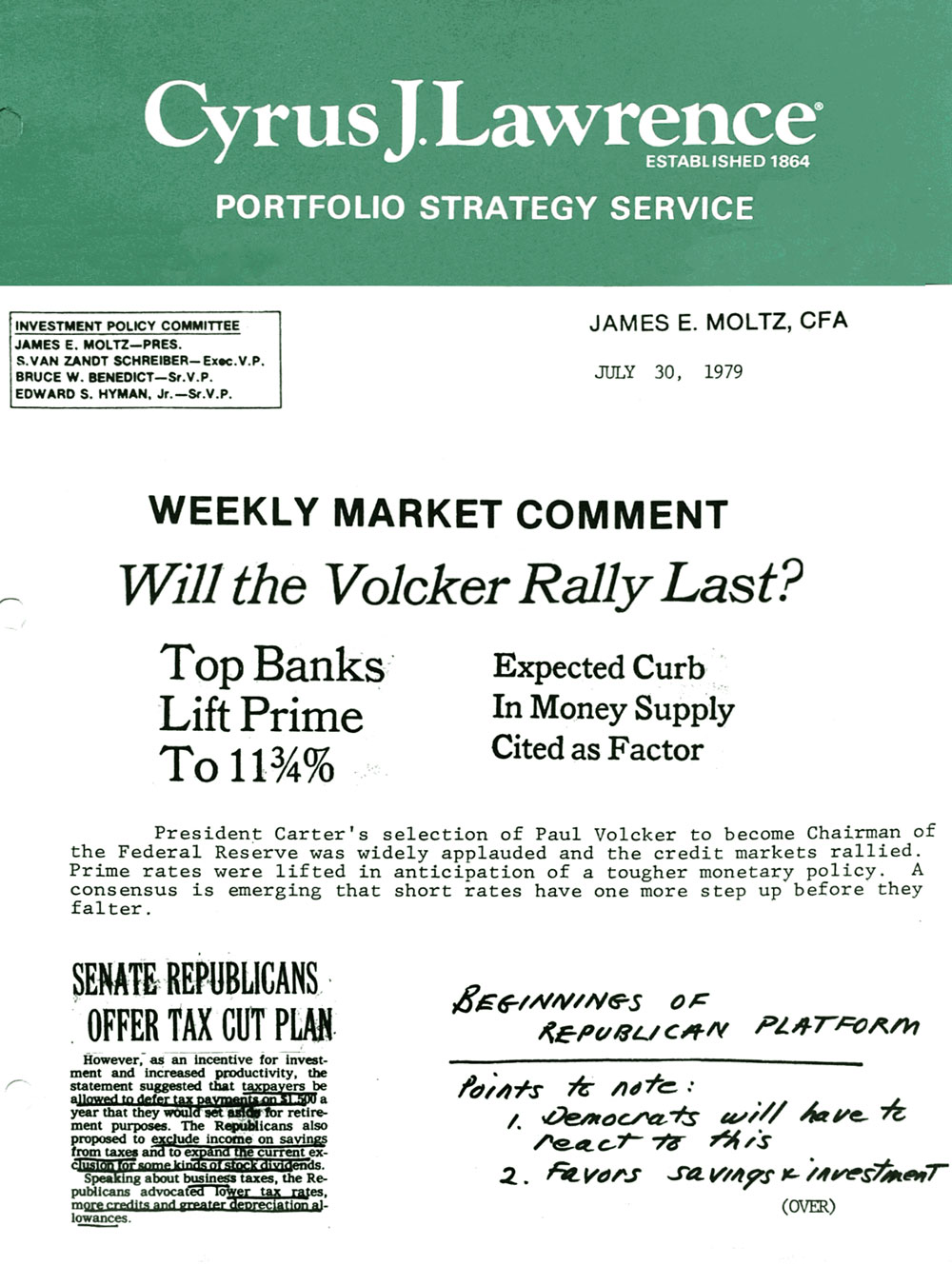

C.J. Lawrence Weekly Market Comment - Will the Volcker Rally Last?

1979

Jim Moltz appointed Chairman and President of Cyrus J. Lawrence

1973

Ed Hyman joins Cyrus J. Lawrence

1972

Bruce Benedict joins Cyrus J. Lawrence

1965

Cyrus J. Lawrence publishes "Comparative Valuation of Common Stocks," a discipline we continue to practice today

1959

Cyrus J. Lawrence & Sons - Photograph by Richard H. Lawrence