- October 21, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – The Patient is in Recovery and the Prognosis for Health Care Stocks Look Good

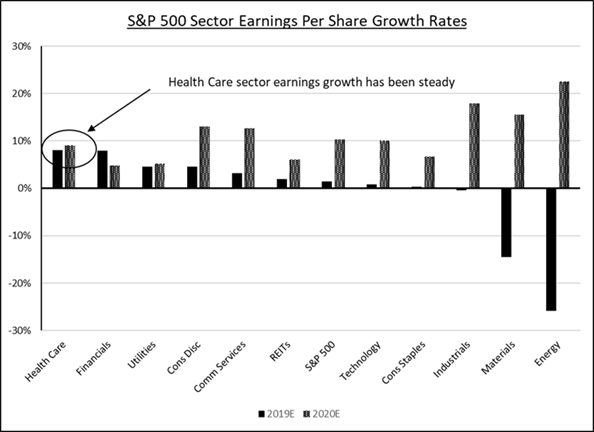

Health care stocks have been some of the market’s worst performers year-to-date. The S&P 500 Health Care Sector Index is up 6% since Jan 1, 2019, lagging the S&P 500 by over 13%. The sector is tracking ahead of only Energy, which is down ~1.0% for the year. The underperformance comes despite relatively robust and consistent earnings growth and expectations. But, understandably, its difficult for investors to get excited about health care stocks when presidential candidates are using the sector as their platform pinata, the President is threatening executive action on drug prices, and record penalties are being levied by judges and juries against pharmaceutical and device manufacturers and distributors in marquee litigation. To be sure, there is bi-partisan support in Congress to drive consumer health care costs lower, and its likely that some new regulations and/or laws will be implemented regardless of which party takes control of the executive and legislative branches of government in the next elections. But irrespective of election outcomes, health care will remain a meaningful component of the U.S. economy and demographics support the thesis that the U.S. population’s medical needs are growing.

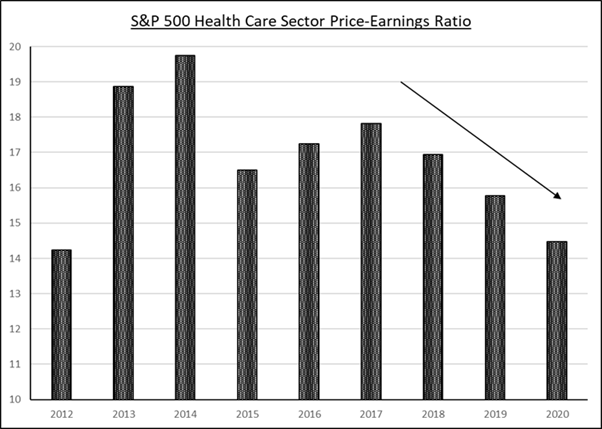

By 2029, when the last round of baby boomers reaches retirement age, the number of Americans 65 or older will climb to more than 71 million, up from about 41 million in 2011, a 73% increase, according to U.S. Census Bureau estimates. Meanwhile, a study by the Kaiser Family Foundation shows consumers over the age of 55 account for more than 50% of U.S. medical spending. Thus, regardless of potential changes in the way health care is administered, the demand for medical services will continue to grow. As Americans live longer lives, that pool is expected to expand even further. But despite the bullish fundamental outlook, health care stocks are trading at reduced price-earnings and price-cash flow multiples on regulatory fears and uncertainty. After lagging the broader market for over a year, the risks look to be mostly priced in, setting the stage for potential upside and outperformance.

As the health care field evolves, leadership is emerging in new areas. Advances in the areas of artificial intelligence, genomic sequencing and diagnostics, medical technology, robotic surgery, 3-D printing, and other developments are changing the way patients are monitored, diagnosed, and treated. In some cases, innovation is coming from established industry participants that possess the balance sheets to support entire product cycles, from discovery to commercialization. And in other cases, innovation is being driven by new entrants. Investors may find the current backdrop enticing, with opportunities across the risk spectrum. Cutting edge companies are now trading near historic low valuations, presenting patient investors with attractive entry points. The anti-health care company rhetoric may be at a fevered pitch, but history suggests that buying the leaders in the midst of all the noise can be a winning strategy.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.