- October 7, 2022

- CJ Lawrence , Market Commentary , The Trusted Navigator - Bernhard Koepp

Two steps forward, two steps back. High inflation remains front and center. – C.J. Lawrence – Market Commentary – 10/7/2022

Markets finished the week up 1.8%. Recent economic data continues to be good for workers and bad for markets. We are still adding jobs at a healthy 250,000+ monthly rate. The unemployment rate remains at a very low 3.5%. This is consistent with tight labor markets and continued inflationary pressures from wages. The bottom line is the economy in the US is still too strong for a Federal Reserve, which is hell-bent on putting the economy into a recession to get inflation back down to its 2% target.

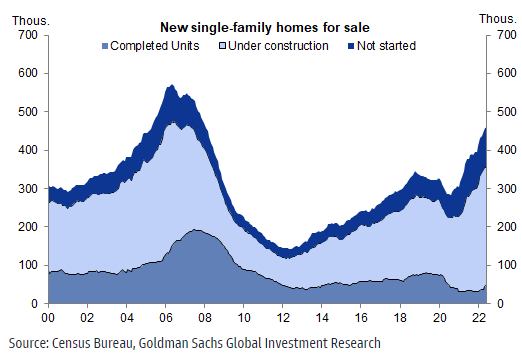

The job-openings (JOLTs) data earlier this week gave the Fed (and markets) some better news, with approximately 1.1 million fewer job openings. It is clear the economy is slowing, and some of the slack in tight labor markets is being absorbed. All eyes are on the September inflation number next week, which will be market-moving. We will watch if the core inflation data measures services (PCE ex-food and energy) remain stubbornly high. It was last month’s core-inflation data that took the market back down to the June low. Looking at the various components, including housing and labor, we may get some relief on the housing front. Apartment demand fell again in Q3, a first since December 2020. Vacancy rates for apartments remain very low at 4.1% but up 1% in Q3. Falling residential home prices, especially on the high end, combined with high mortgage rates and an increasing supply of homes (see chart), should put a lid on housing inflation. Our base case remains that inflation will continue to slow and that longer-term interest rates are near a peak.

The US Dollar continued its uptrend versus other currencies. This is good news if you are planning a European vacation but is bad news for the global economy, which is reeling from the Ukraine-War induced energy crisis and US-Dollar-denominated debt, which many developed- and emerging economies had accumulated when our interest rates were near zero. The expectation is that something will break in the global economy. That nearly happened in the UK, where the new Prime Minister Truss forgot her basic economics, implementing highly inflationary tax policies directly contradicting her central bank. This policy misstep nearly destroyed several UK-defined pension plans loaded up on derivatives to hedge future liabilities. These derivates (aka LDIs: Liability-Driven Investments) were subject to a massive margin call-forcing selling of the more liquid UK government bonds (GILTs), pushing the price of UK GILTS down 50%, hours away from a disaster before the Bank of England intervened to provide liquidity. This could have been a “Lehman moment,” but shows how much better equipped global policymakers and markets have become when responding to severe liquidity events. It goes without saying, lessons were learned from the global financial crisis in 2008/09.

Have a great weekend!

Bernhard

Bernhard Koepp is CEO and Portfolio Manager at C.J. Lawrence. Contact him a bkoepp@cjlawrence.com by telephone at 212-888-6342.