- November 7, 2017

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – U.S. Economy is Supportive of Accelerating S&P 500 Top-Line Growth

It was not surprising that the U.S. Federal Open Market Committee decided to leave interest rates unchanged last week, but the pressure seems to be mounting for a December move. The third quarter GDP result of 3.0% was followed, last week, by an impressive ISM Non-Manufacturing Index reading of 60.1%. That was well ahead of the 58.1% reading expected by most economists. A reading above 50% indicates improvement. On Friday, the U.S. government reported that the economy added 261,000 jobs in October, despite the impact of hurricanes, and that the unemployment rate fell to 4.1%, the lowest level since December 2000. The backdrop for corporate sales and profit growth continues to improve.

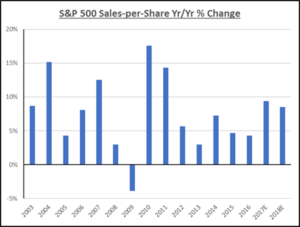

For the past five years, top line growth for S&P 500 companies has averaged 2.3% while average annual GDP growth was 2.2% over the same period. Corporate managements employed a combination of debt refinance, share repurchases, and corporate efficiency initiatives to grow profit margins and earnings. Average earnings per share growth for the Index during the same period was 3.9%. With margins currently holding at high levels, and the economy increasing its pace, investor focus is returning to top line opportunities and market share growth to help identify portfolio winners.

Reported S&P 500 sales per share growth, for 3Q17, has been encouraging. With over 80% of constituents having reported results, S&P 500 sales are coming in 5.8% ahead of last year’s levels. That figure would be 4.6% if the Energy Sector was excluded. 66% of the sales reports have come in ahead of analyst expectations. That is well ahead of the five-year average of 55%. Leading in top-line growth are the Energy and Materials Sectors, both of which are coming off relatively depressed levels. Not far behind is the Technology Sector which is posting 10.2% sales growth to date. The Internet Software and Services and the Semiconductor and Semiconductor Equipment industry groups are bolstering the Index with 25% and 16% top line growth, respectively. Stocks in these sub-indices have reacted accordingly. Companies with leading edge products and services, serving large markets, and operating at attractive margins, that continue to grow their top lines at a double-digit pace are relative outperformers in any market. The Technology Sector includes companies that possess many, or all, of these characteristics, and should therefore remain a meaningful market overweight sector in growth portfolios.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.