- April 1, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – The Market Gets a Lyft, but Equities Can’t Find Long Term Love

If you returned from a remote, deserted island (without wifi!) and were told that the U.S. 10-Year Treasury Bond yield had declined another 32 basis points in 1Q19, on continued fears of slowing global economic growth, it is not likely that you would have guessed that stocks staged an impressive rally during the same period. But that is exactly what happened. After shedding 55 basis points from peak treasury yields in 4Q18, interest rates at the long end of the treasury yield curve took another leg down in 1Q19. The flattening of the curve caused yields to invert at several shorter duration maturities. Meanwhile, the S&P 500 closed out last week with a 1.2% gain, a 1.8% monthly rise, and a first-quarter advance of 13.1%, the best quarterly performance since the third quarter of 2009.

We watched with interest, last week’s initial public offering (IPO) of ride hailing company Lyft Inc. (NASDAQ: LYFT) and viewed it as good barometer of investor risk appetite. The successful share float confirmed recent market action suggesting that investors are hungry for growth, and in some circumstances are willing to forgo current earnings to find it. On Friday, Lyft raised $2.34 billion and saw its share price rise in the after-market from the offering price of $72 to close at $78. That values the “tech unicorn” at ~$22.4 billion, even though the company lost $911 million on $2.2 billion in revenue in 2018. But the $2.2 billion in revenue was up 100% from the previous year, and the company reported that 4Q18 revenue growth eclipsed 168%! Top line growth of that magnitude is attractive in any market and investors found Lyft’s relative revenue growth trajectory worthy of valuation creativity. The successful new offering was a boon to the broader market which seems to be feeding off improving sentiment and momentum.

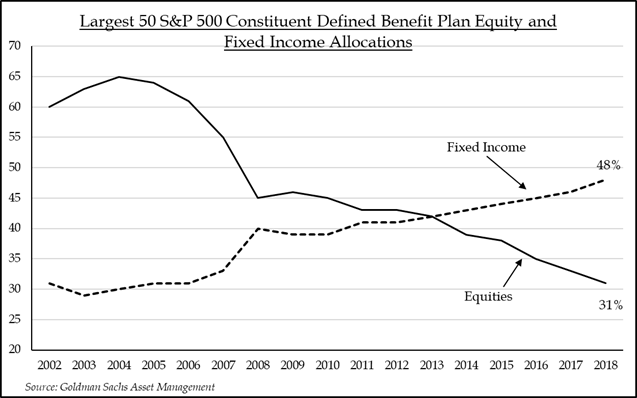

But despite the unbroken, albeit irregular, gallop of the equity bull market, most large institutional investors are not finding it worthy of overweight exposure. In fact, a recent release from the California State Teachers Retirement Fund (CalSTRS), the largest teachers’ retirement fund in the U.S., managing over $225 billion in assets, stated that the fund was cutting back on its target global equity exposure from 53% to 51%. CalSTRS strategic downshift in equity exposure is consistent with moves by other large pension, foundation and endowment funds which have been reducing target and tactical equity exposure since before the financial crisis in 2008. A recent study by Willis Towers Watson showed that major U.S. pension funds reduced their strategic allocation to equities from 60% in 2007 to 50% at the end of 2017. By the end of 2017 the size of U.S. pension market was believed to be in excess of $25 trillion in assets. Therefore a 10% shift in allocation would account for close to $2.5 trillion is lost equity exposure in 2017 dollars. U.S. domestic equities are believed to account for ~65% of that exposure.

J.P Morgan’s recent “Corporate Pension Peer Analysis 2018” study corroborated this trend and suggested that 2018 was the “largest asset allocation de-risking year for defined benefit (DB) plans since 2011”. A recent Goldman Sachs Asset Management study of S&P 500 constituent defined benefit plans showed that the top 50 plans reduced their equity exposure to 31% and raised their fixed income exposure to 48% in 2018, reaching their largest fixed income allocation on record. Despite this consistent reduction in equity exposure among U.S. pensions, foundations, and endowments, the S&P 500 has generated a cumulative total return of 290% since January 1, 2009, versus a 43% return for the iShares Long Treasury Bond ETF (TLT) during the same period. If stocks can perform this well when they are out of favor, it begs the question of how they would perform when allocations are rising. Stubbornly low yields on fixed income instruments may give us the opportunity to see the result.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.