- November 11, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Technology Sector Supports Higher S&P 500 Profit Margins

What a difference a year makes. Last fall we wrote about profit margins and the fear, at that time, was that margins had peaked and would come under pressure from higher corporate borrowing costs and higher inflation. In November of 2018 the Federal Reserve was in tightening mode, the U.S. 10-Year Treasury yield broke through 3.0%, and fears of inflation were being fueled by historically low unemployment levels which were expected to push wages and prices higher. Fast forward to this year when interest rates across the yield curve have been declining, the 10-year yield is struggling to breach 2.0%, and unemployment has fallen further without a commensurate increase in core inflation.

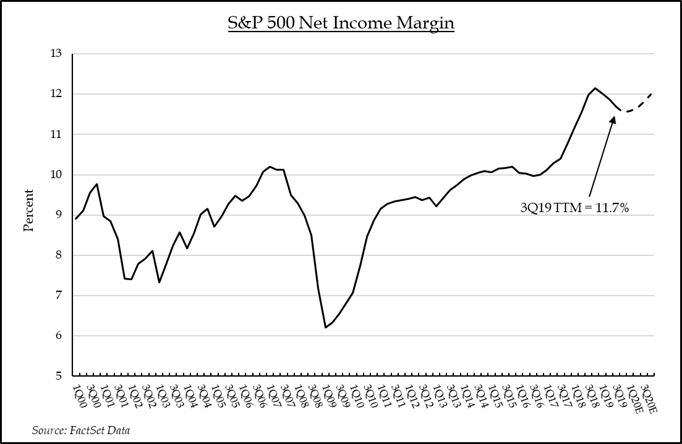

S&P 500 profit margins have not fallen much since peaking in mid-2018. On a rolling 12-month trailing basis margins were 11.7% at the end of the third quarter, including a blended rate of companies that reported results for the quarter and estimates from those that have not. Margins remain at historically high levels and analysts’ bottoms up forecasts suggest they could trend higher over the next several quarters. Sales forecasts are supportive and inflation expectations are tepid, which isn’t encouraging for pricing power, but it is for expense management.

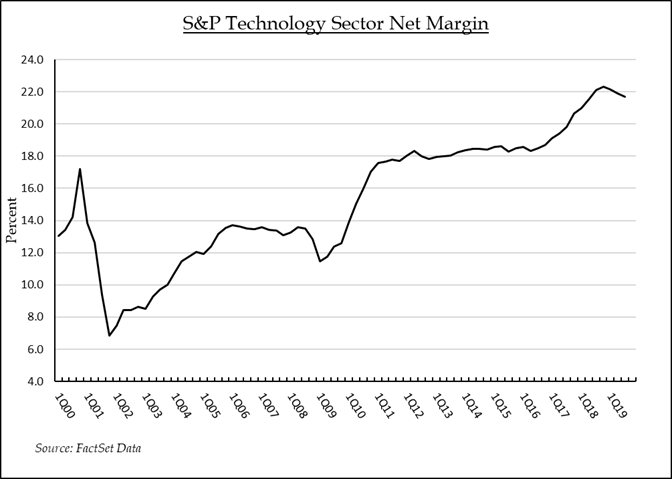

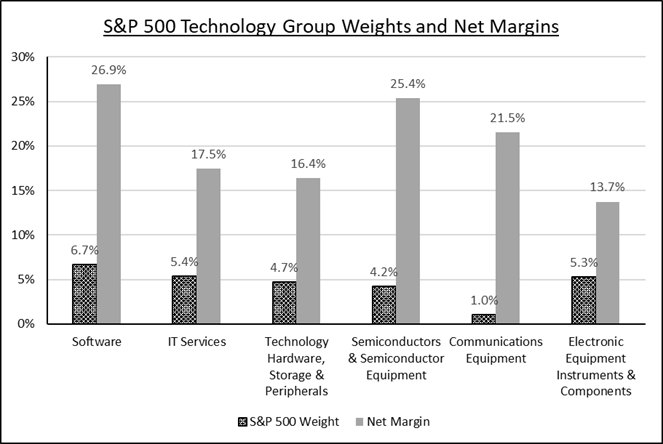

Technology sector constituents are eating their own cooking, helping to increase productivity and expand margins of their customers, but doing so in-house as well. The sector accounts for the largest weight within the S&P 500 Index so its strength gives support to the broader index’s margin expansion. Within the sector, the Software, IT Services, Hardware, and Semiconductors groups, which account for over 21% of the entire S&P 500’s weighting, all have net margins in excess of 15%. According to analysts surveyed by FactSet those margins are heading higher. Historically, margins compress late in the business cycle as cost inflation outpaces top line growth and economic growth slows. But currently, profit margins are showing resiliency in the face of slowing growth. That is constructive for corporate profits and may elongate an already extended business cycle. Technology sector leadership is important and is likely to continue.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.