- June 18, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Moderate Inflation Supports Healthy S&P 500 Revenue Growth

The May Consumer Price Index (CPI) reading, released last week, came in close to 2.8% with the core reading at 2.2%. The Producer Price Index (PPI) reading echoed the improvement with a 3.1% annualized advance. The healthier pricing environment was confirmed in the Empire Manufacturing Index reading which came in hotter than expected, with all pricing metrics remaining high. These are encouraging reports for inflation watchers who have been hoping that the past decade’s monetary stimulus initiatives would usher pricing power back into the U.S. economy. The Federal Reserve Board likely took comfort in these advances when they raised the target Fed Funds rate by 25 basis points last week. Somewhat surprisingly, the equity markets have taken the reports, and the expected rate hike, in stride, with the S&P 500 index price performance flat for the week and up 2.5% in the last month. Perhaps stock investors are taking their cues from the bond market and from gold, which seem to be forecasting a firm pricing environment but no runaway inflation. The U.S Benchmark 10-year U.S. Treasury bond yield fell 2 basis points last week and is down 15 basis points in the past month. Gold prices, which tend to rise in tandem with inflation, are down 2.1% year to date.

Moderate inflation can be a constructive force for higher Gross Domestic Product (GDP) and corporate sales growth. A combination of volume growth and higher prices are currently at work helping S&P 500 companies grow revenues at their fastest pace since 2011, when the economy was climbing out of recession. Double digit top-line growth in the Energy, Industrials, and Technology sectors are driving this year’s forecasted 7.9% revenue improvement. Next year, without the benefit of expanding Energy sector revenues, which are expected to slow to 0.5%, and considering sub-3.0% revenue growth contributions from the Telecom and Materials sectors, S&P 500 Index revenue growth is expected to slow to a healthy 4.5%, before reaccelerating in 2020 at a 5.5% rate.

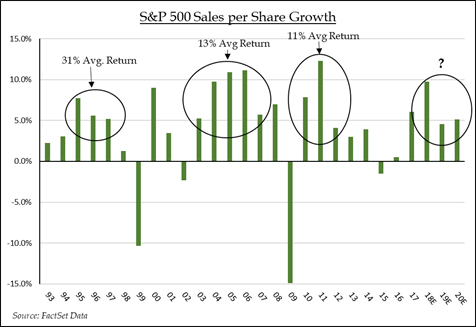

S&P 500 Sales per Share Growth

Consecutive multi-year revenue growth, above 4.0% annually, has historically been a strong underpinning for stock prices. Over the past 25 years, there have been three periods when the S&P 500 produced 4.0%+ revenue growth for three or more consecutive years. During those periods the average annual total returns on the Index were 31%, 13%, and 11% respectively. The current cycle started in 2017 with 6.5% top line growth and an S&P 500 Index total return of 21.8%. If the forecasts prove correct, the market has at least another three years of robust revenue growth to go. Within the Index, the highest rates of forecasted multi-year top line growth can be found in the Technology, Industrials, and Consumer Discretionary sectors. Shares of companies in these sectors that are taking market share, developing new markets, and driving top-line expansion warrant meaningful overweight positions in growth portfolios.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.