- August 20, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly Market Comment – Back to School with 529 College Savings Plans

Today’s American families are spending record amounts of time and resources on their kids’ activities, and parents are pulling out all the stops to enable and encourage their children’s success. Research conducted by Utah State University in 2015 suggested that families included in their study spent up to 10.5% of their gross income on youth sports alone! This significant commitment comes at a time of diminishing odds that American kids will play professional or college sports, perform with the NY Philharmonic, act in a Broadway show, or qualify for the U.S. Olympic team.

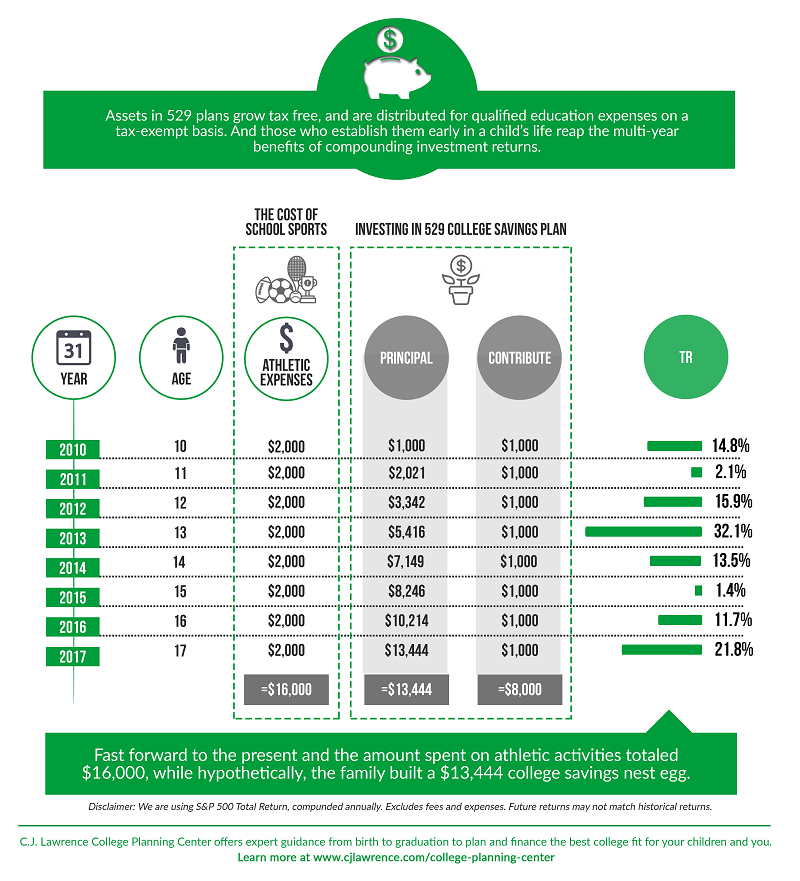

Of course, participation in most forms of youth activities including sports, the arts, clubs, and other enrichment programs, have social and developmental benefits for children, and teach them important life lessons. But in today’s society, there appears to be a mismatch in resource allocation when measured against outcomes. While less than 1% of high school athletes will participate in NCAA Division I athletics, almost 70% of high school seniors will attend some form of college after graduation. Yet, as youth athletic program spending soars, only 22% of American families, that are actively saving for college, have opened 529 college savings plans. Of course, 529 plans are not the only available programs for college savings, but most financial professionals view them as the most effective and tax efficient. Indeed, assets in 529 plans grow tax free, and are distributed for qualified education expenses on a tax-exempt basis. And those who establish them early in a child’s life reap the multi-year benefits of compounding investment returns. Some states even allow 529 plan contributions to be deducted from the contributor’s taxable state income.

Among the reasons cited for not saving for college, most families place (1) lack of funds, and (2) competing priorities, near the top. But detailed analysis of family spending patterns often encourages a reallocation of resources and uncovers opportunities for college savings carve-outs and matched spending. A hypothetical example illustrates the benefits. In the example scenario, the parents of a 16-year-old spent $2,000 per year on their child’s athletic programs, beginning in the child’s ninth year. During the same period, they contributed half of that annual amount ($1,000 per year, or $83 per month) to the child’s 529 college savings plan, invested in an S&P 500 Index fund. Fast forward to the present and the amount spent on athletic activities totaled $16,000, while hypothetically, the family built a $13,444 college savings nest egg. This hypothetical example does not incorporate fees and expenses, and future returns may not match historical returns. But it does illustrate the advantages of starting 529 plans early, and allocating a percentage of activity spending to education, while also highlighting the tax and compounding returns benefits inherent in 529 college savings plans.

During March and April every year, more that 20 million American students open mailed and online letters from college admissions officers. The “decision letters” which are often the culmination of months, and sometimes years, of preparation and hope, can be a cause for celebration. For others, they can be a source of disappointment and despair. But for students who achieve their dream of acceptance to the college of their choice, only to be confronted with the cold hard reality of the out-of-reach cost of matriculation, excitement can quickly turn to anxiety and frustration. Preparing a plan now can help families avoid that difficult quandary in the future.

Whether your student is “in the zone” of the college admissions process, or you are just getting started down the path of considering college savings, the CJ Lawrence College Planning Center has important information and insights you need. Log on to explore thousands of colleges and universities, majors, demographics, statistics, and costs. Input current, or prospective, scores and grades to see how your student stacks up versus previous applicant pools. For families with young children, build a road map for college savings and compare different state run 529 College Savings Plans. The resources you need at each stage of the process are available at the C.J. Lawrence College Planning Center website. Of course, before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.