- April 22, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – India’s Election May Have Broad Implications for the Global Economy

As U.S. investors evaluate the policy positions of the growing field of candidates for the 2020 U.S. presidential election and attempt to gauge the impact of the recently released Mueller report, the world’s largest election has commenced in India. The first phase of the seven-phase Indian parliamentary election, which includes up to 900 million voters, began on April 11, with the last phase scheduled to begin on May 19, and results scheduled to be announced on May 23. The current leader, according to most national polls, is the Bharatiya Janata Party, led by current Prime Minister Narenda Modi. The election is important to both the Indian and global economies. A second term would embolden Modi and his party to accelerate the economic reforms undertaken in his first term and potentially thrust India further onto the global economic stage adding another powerful player to the global trade mix.

Source: International Monetary Fund

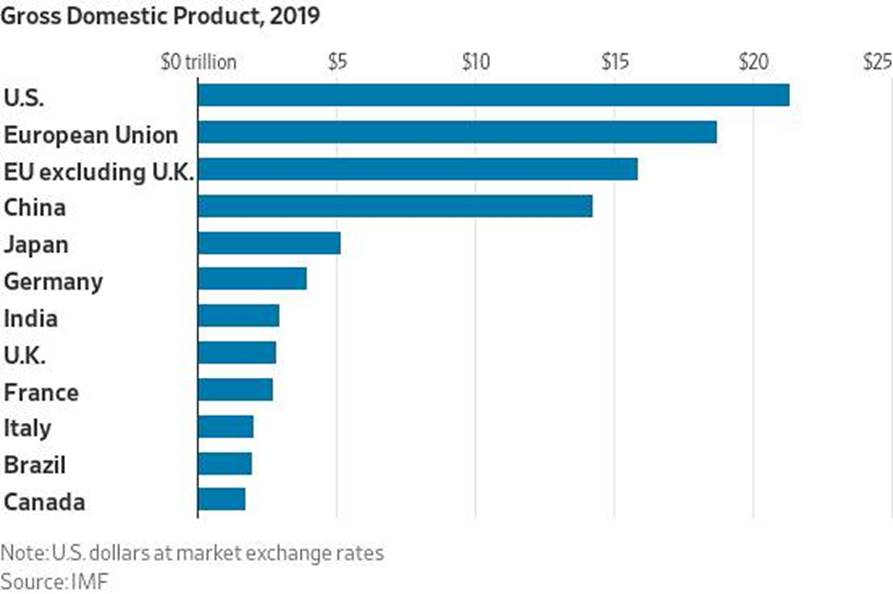

This year India will surpass France and Britain to become the world’s fifth-largest economy, according to the latest IMF numbers. At projected 7.3% growth in 2019 and 7.5% projected growth in 2020, India is also the world’s fastest growing major economy. Previously regarded as one of the globe’s more challenging places to do business, under Modi, India improved its ranking in the World Bank’s Ease of Doing Business report for the second straight year, jumping 23 places to the 77th position on the back of reforms related to insolvency, taxation and trade. To be sure, India still has a long way to go before becoming a driving force of global economic growth. Its share of global trade rose to 1.7% in 2018, up from 0.7% in 2000, but that still falls well short of major global trade contributors like China (12.7%), Japan (3.9%), and South Korea (3.2%). But India’s potential should not be underestimated.

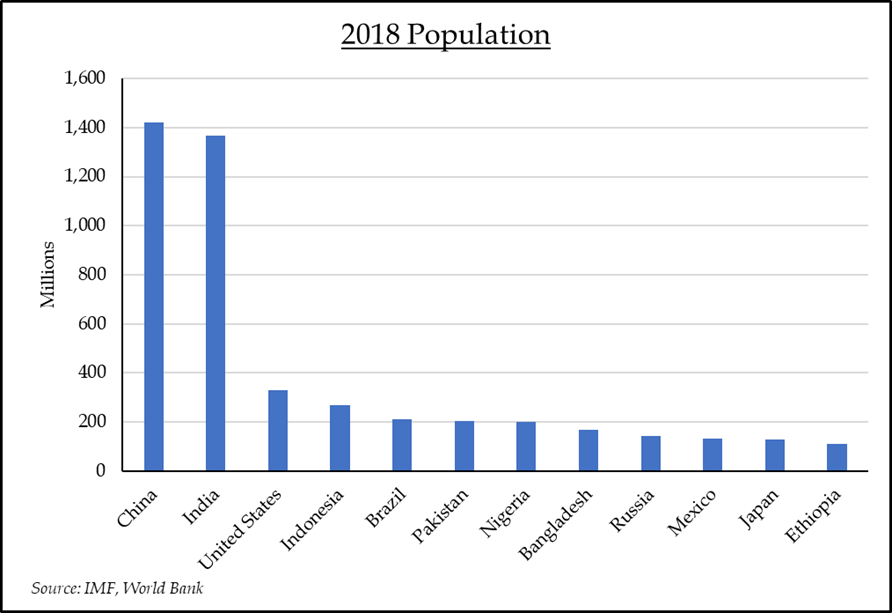

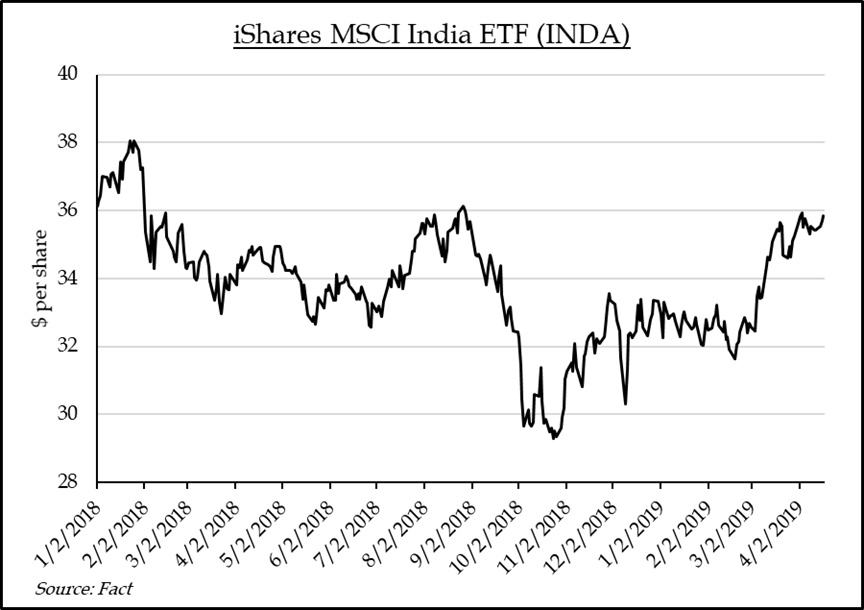

Despite less than ideal job growth, India’s economy is being fueled by surging consumer spending by the country’s massive population and growing middle class, and by favorable demographic trends. The United Nations expects India’s current population of 1.3 billion to surpass that of China by 2024 to become the planet’s most populous nation. At the same time, a study from Ernst and Young suggests the size of India’s middle-class population will reach 200 million by 2020. Other reports have put that figure closer to 300 million. Concurrently, the potential workforce in India is set to climb from 885 million to 1.08 billion in the next twenty years. Meanwhile India has more than 50% of its population below the age of 25 and more than 65% below the age of 35. India is also the second fastest-growing market for digital consumers. The country had 560 million internet subscribers in 2018, trailing only China according to a study from the McKinsey Global Institute. The report suggested that core digital sectors could contribute $355 billion to $435 billion to India’s GDP (Gross Domestic Product) by 2025. India’s rapid rise bears watching for both its contribution to the global economy and potential impact on global economic growth rates, and for the equity investment opportunities the country’s evolution creates.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.