- December 3, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Earnings on Watch

The trade détente between the United States and China may provide temporary relief from the negative sentiment around global trade. Whether the dialogue can transition into an actual agreement will play out over the next several weeks. But to date, despite growing consensus expectations of both slowing international trade and global growth, company analysts have not dramatically ratcheted back their 2019 sales and earnings growth forecasts and are therefore unlikely to raise them if a deal is consummated. On third quarter earnings calls, dozens of companies cited uncertainty around global trade as a potential headwind for future quarterly results, but very few took a shot at trying to quantify the impact. The analysts, meanwhile, have been attempting to recalibrate forecasts against what is turning out to be a record high in S&P 500 quarterly sales and earnings. As the last few 3Q18 company results trickle in, it appears that quarterly earnings growth will come in around 26% higher than last year, and sales will be up 9.5% during the same period.

Third quarter results have eclipsed even the most optimistic expectations. 78% of reporting companies delivered earnings results in excess and mean expectations while 68% of reporting companies exceeded sales forecasts. However, strong corporate financial performance has not been enough to off-set the growing fears of “peak earnings” and trade-related disruption. In fact, companies that generated positive earnings surprises for 3Q18 experienced stock price increases of only 0.1% in the four-day period surrounding their earnings release (two days before and two days after). Companies that delivered results that fell below analyst expectations experienced average stock price declines of 3.1%, worse than the 2.5% average decline set over the past five years.

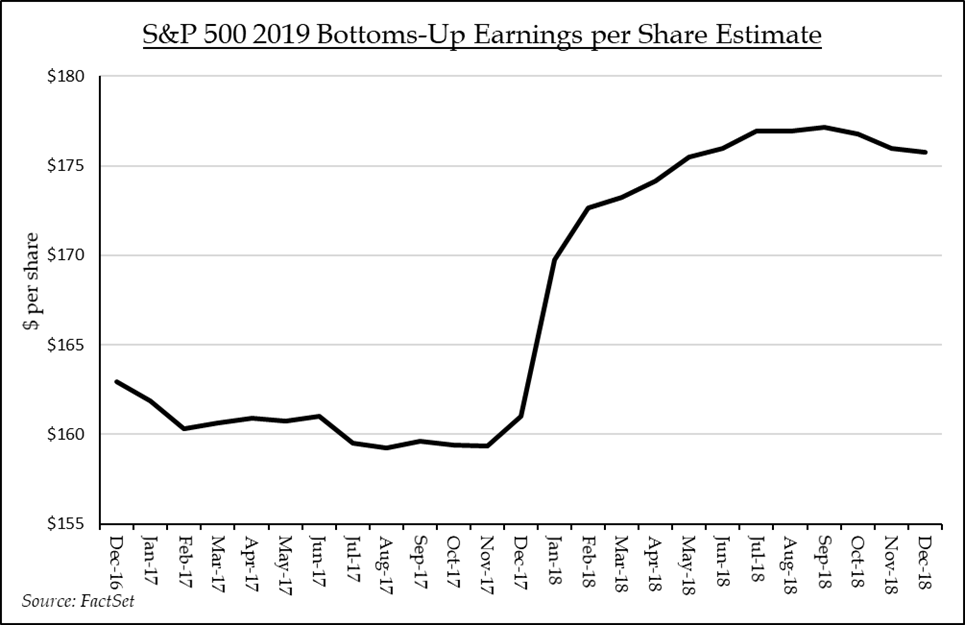

S&P 500 2019 Bottoms-Up Earnings per Share Estimate | Source: FactSet

Corporate sales and profit forecasts for 2019 are little changed over the past few months. Rates of growth have been trimmed but primarily due to better-than-expected 2018 performance without a corresponding lift to absolute 2019 expectations. According to FactSet, bottoms-up forecasts for the S&P 500 call for earnings of ~$176 per share in 2019 and ~$195 per share in 2020. Both assume profit margin expansion beyond the current record level of around 12%. We think that analyst profit margin expansion expectations may be too optimistic given rising labor, materials, and transportations costs. Should Chinese and U.S. trade negotiators fail to avert even a minor trade war, further pressure could be exerted on margins. Using flat margins on 2019 sales expectations would give us an earnings result around $170 per share. Applying a P/E multiple range of 15x to 17x against that estimate would suggest an S&P 500 price range of 2,550 to 2,900 over the next twelve months. With the index currently trading around 2,760 that would suggest downside risk of about 7%, and upside potential of around 5%, putting the broader markets’ risks and rewards close to balance. In this type of environment, the challenge for managers and investors is to find and own stocks of companies that grow market share and control their own destinies and avoid stocks of companies that require a lift from the market to perform. We increasingly find these names in the technology and health care sectors, and in select consumer discretionary industry groups.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.