- April 16, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C. J. Lawrence Weekly – Cash Flow on the Rise

A once highly anticipated technology sales pipeline report was released on Wednesday with little fanfare. Worldwide shipments of traditional personal computers (desktops, notebooks, and workstations) in 1Q18 were equal to last year’s level, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. The result was viewed positively by industry watchers who consider flat to be the new up in a market that has undergone dramatic change over the past decade. The evolution of mobile and networked devices, as well as cloud-based software and solutions, have supplanted the traditional PC hardware and software business models resulting in a steady decline in traditional PC sales. But during the reign of the PC, the IDC report was a market-moving event for the entire technology ecosystem. Followers of Hewlett Packard, IBM, Microsoft, Intel, and others closely monitored the report for clues on business activity and trends across the technology landscape. The report now plays a minor role for market participants who are more focused on the evolution of cloud computing, artificial intelligence, machine learning, and the internet of things (IoT).

But the IDC report also serves as a reminder that solid core franchises, even ones that no longer grow, can generate meaningful cash flow to support growth businesses, and creates optionality for corporate management teams. Microsoft is a good example. Revenue generated from sales of the company’s Windows operating system have remained remarkably steady, while its percentage of total corporate revenues has dropped to a historic low. The Windows business, which after a recent restructuring sits in the company’s Experiences and Devices business line, is not growing, but generates considerable cash flow that supports Microsoft’s growth and shareholder return initiatives. In the company’s fiscal year 2017, which ended in June, Microsoft generated over $31 billion in free cash flow. That allowed Microsoft to pay out $11.9 billion in dividends, repurchase $11.8 billion worth of common stock, and pay down $12.9 billion of the company’s higher interest rate debt. That all came after spending $12.1b billion on research and development.

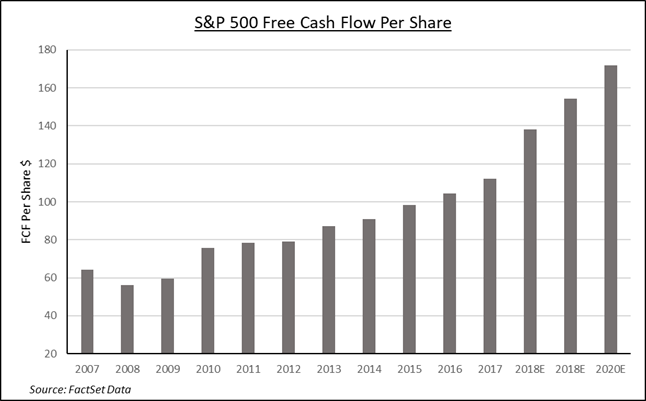

S&P 500 Free Cash Flow Per Share

At a broader level, free cash flow (after capital expenditures) generation from S&P 500 companies is expected to reach record levels in 2018, and grow at a double-digit rate in 2019 and 2020. That is an important underpinning for the index. Stocks tend to perform well during periods of increasing cash flow. Corporate managements will be challenged to put capital to work to generate shareholder returns through growth initiatives, M&A, share repurchases, dividend increases or some combination of each. By most measures, they will have the cash to deploy. Companies, with cash generating core businesses, legacy or otherwise, create additional optionality for their management teams, separating those who can create value and those that can not. We screened the S&P 500 for companies with debt-to-total capital ratios below 30%, that grew free cash flow per share in excess of 10% each year for the past three years. Our constructed equally-weighted index of qualifiers has generated 570 basis points of excess return year to date, versus the S&P 500. In volatile markets, stocks of companies with strong cash flow characteristics are good bets.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.