- April 17, 2018

- Blog , The Trusted Navigator - Bernhard Koepp

Regs vs Tech: Then and Now…Lessons from the Past

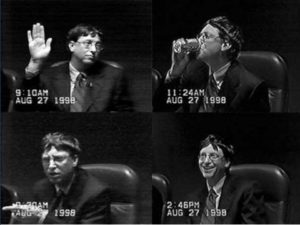

One thing we have become accustomed to over the years is the fact that dominant companies, which we call Bulldogs at C.J. Lawrence, tend to get sued or attract regulatory scrutiny precisely because they are so successful. Microsoft was one of the first to attract such scrutiny back in 1992, when the government started looking into Microsoft’s dominance based on its operating system. The government then claimed that Microsoft was deliberately creating a choke hold on access to the internet by bundling its internet browser (Explorer) into its software. At 37, Bill Gates (Mark Zuckerberg is 33 now) was eventually asked to testify in front of Congress in August of 1998, see picture below. The Government finally proposed a settlement in 2001. Microsoft actually never settled and the suit finally expired in 2011. How did MSFT do during this period? It rose 57% vs 17% for the S&P500 (5/1998 to 6/2001). The lesson here is that increased government scrutiny is not necessarily bad for stock prices. Investors do remember a period in Microsoft’s history from 2001 to 2006 when the stock went sideways. This had more to do with losing its competitive edge in a changing software landscape, which favored mobile devices over PCs, rather than with being chased by regulators.

Then…Bill Gates in 1998:

and Now…Mark Zuckerberg in 2018:

What is our view on Facebook? We have mentioned in the past that we are concerned with Facebook’s, and others’, vulnerability to rising regulatory scrutiny. This should not come to anyone’s surprise given that Facebook and Google enjoy a 57% combined market share in the digital advertisement space. To give you a bit of context, total media spend on digital platforms surpassed media ad spend on TV only back in 2016. The total media ad spend in the US last year was about $200 bn and grew about 6%. That growth was largely driven by digital. To put the US media ad spend into a global context, last year total ad spend globally was about $530 bn and grew about half the rate of the US market, at just over 3%. Logic follows that as the US digital ad spend becomes a larger part of the total global advertisement pie, growth will naturally slow unless the overall market can expand.

Before the internet even existed, advertisement spend was always closely tied to GDP growth. What this means for investors is that we need to be aware of saturation points. With this in mind, we are focusing very closely on market share trends within digital ad spend. So far, there is no sign that the Facebook/Google duopoly will be replaced any time soon. Global advertising spending is expected to grow by 3.8% in 2018. Between 2016 and 2019, Eastern Europe and Central Asia are expected to be the fastest growing regional ad markets worldwide. The average growth rate of ad spend in that region is expected to amount to 9.2% annually. The fastest growing medium is projected to be mobile internet, growing by 76.05 billion U.S. dollars in the same period. In short, we are still comfortable with our exposure to Facebook (and Google), given its lack of competitors, attractive valuation and high growth rate.

BK

04/17/18

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.