- February 11, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Bond Market and Stock Analysts in Sync on Slower Growth

Last week’s announcement from the European Commission that it had lowered its 2019 economic growth forecast for the Eurozone from 1.9% to 1.3% broke a string of positive events and announcements that had helped lift stock prices from their December lows. Better-than-feared 4Q18 earnings results and forward guidance, an improving outlook for a U.S.-China trade deal, the re-opening of the U.S. federal government, and a strong employment report had all contributed to a positive shift in investor sentiment. In the weekly American Association of Individual Investor survey, bearish sentiment fell from 50.3% in the pre-Christmas week, to 22.8% last week. Up 8% year-to-date, and 15% from December lows, the market has retraced most of the late 2018 declines. With the market now back on solid footing, investors are re-casting their focus on the forward-year economic and profit outlook to calibrate risk appetite and market expectations.

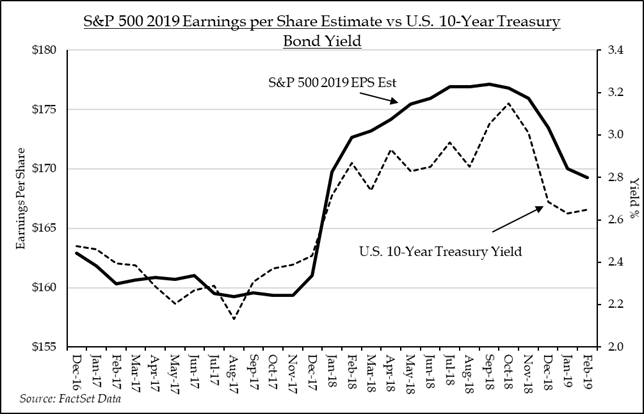

Analysts contributing to the S&P 500 earnings per share FactSet consensus appear to be in sync with the bond market in forecasting meaningful slower U.S. growth. The 10-Year U.S. Treasury Bond yield peaked in October of 2018 at 3.23% and closed Friday at 2.63%. During that same period, S&P 500 Index earnings per share forecasts fell from $177 to $169. While investors appear to have digested the prospects for slower growth, the looming question is whether forecasts will fall further. But shifts in valuation suggest that the market is anticipating a bottoming process for S&P 500 forecasts. In the past month, the price/earnings multiple on the S&P 500 has climbed from 14.2x to 16.6x 2019 estimates, while the estimate has declined by 4.0%. It is rare for the market multiple to continue to expand in the face of declining profit forecasts, unless the market anticipates a bottoming in those forecasts. The consensus calls for 11.4% earnings growth in 2020, suggesting that analysts believe growth will trough in 2018 and reaccelerate late in the year and into 2019.

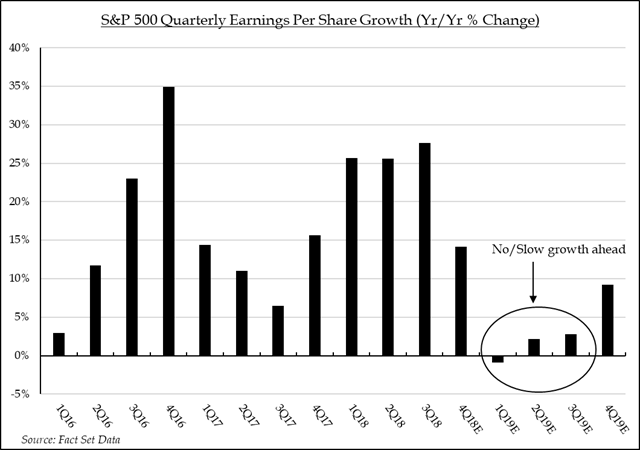

Investors who subscribe to the earnings reacceleration narrative will need to wade through some choppy waters early in 2019. For the first time since 4Q15, quarterly earnings per share are expected to decline in 1Q19 compared to the year-ago period. Growth in 2Q19 is expected to reach only 2.1%, and then 2.8% in 3Q19. The lack of growth may test the mettle of even the most ardent bulls who will need to look to 2020 to justify a P/E driven market gain. Inside the index, the growth profiles of companies with limited foreign sales exposure differs widely from those with heavy foreign sales exposure. For the full year, companies with more than 50% domestic sales exposure are expected to grow earnings per share by 6.7%, according to data provided by FactSet, while companies with more than 50% international sales exposure are expected to grow at a 1.9% rate. Our view is that this disparity will be accentuated in a slow-growth environment, and that the above-market growers will be rewarded with premium valuations.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.