- May 21, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Regardless of Outcome, the U.S.-China Trade Dispute May Accelerate the U.S. Manufacturing Renaissance

Editor’s Note: A month ago we wrote about growing unease among U.S. businesses operating in China. We are recirculating that note this afternoon as trade tensions between the U.S. and China reach a new level. The imposition of tariffs on Chinese imports by the U.S., retaliatory tariffs on U.S. goods by the Chinese, and the sanctions recently levied against Chinese telecom equipment manufacturer, Huawei Technologies, have raised the economic stakes of the dispute and have lowered the odds that a meaningful trade agreement will be reached in the coming weeks. The stock market has reacted by selling anything China related. Apple, which has substantial manufacturing operations in China and derives ~20% of its revenues from China, has experienced a 13% decline in its stock price during the past three weeks. Even Chinese domestic champion, Alibaba Group, has suffered, and is down 17.7% during the same period.

Last week, during its earnings call, Cisco management disclosed that the company has been moving production capacity out of China. Later in the week Stanley Black and Decker announced that it was spending $90 million to relocate production from China to Texas. Those announcements came on the back of previous announcements from toy manufacturer, Hasbro, and big consumer brands like Samsonite, Macy’s, and Fossil Group that they were all moving operations out of China. To be sure, not all relocated China production will find its way to the U.S. But, in our view, the U.S. is likely to be a long-term winner of re-shoring initiatives particularly in the area of manufacturing, accelerating the “U.S. Manufacturing Renaissance.”

China will not stand idly by. Tencent Video just announced that it was delaying the Game of Thrones finale release in China! Coincidence?

Please see our full note below and feel free to reach out with any questions

tgardner@cjlawrence.com or by telephone at 212-888-6403.

Most reports suggest that trade talks between the U.S. and China are progressing at a measured pace and that an agreement is near completion. The expectation that a deal will be reached looks to be priced into the stock market, so a positive outcome would likely be met with sighs of relief instead of champagne corks popping. Both countries, and the rest of the world for that matter, are hoping that a deal will reinvigorate global trade and get global economic growth back on track. Reflecting the recent slowdown, the IMF again lowered its estimate for global GDP growth, this time from 3.5% to 3.3% on the back of lower expectations for growth out of the U.S. and Europe. China’s recent economic data releases are flashing signs of a bottoming and in some cases are showing improvement. Economic stability in China would go a long way to helping the global economy find its footing. But the trade skirmish may have lasting implications for the country once considered the world’s factory floor and may serve as an additional catalyst for the “American Manufacturing Renaissance.” In the eyes of global supply chain and sourcing managers, the trade skirmish highlighted the uncertainties and risks of operating in China, potentially changing the risk/reward calculus of doing business there for the foreseeable future.

For the past two decades China has grown its manufacturing base beyond labor-intensive assembly lines to high end industrial and high-tech equipment assembly and production. According to the United Nations Industrial Organization, China accounted for 25% of the globe’s manufacturing in 2018, up from 8% in 2000. The country has been able to attract the world’s manufacturers with low unit labor costs and a relatively skilled workforce. But that comparative advantage has declined in recent years. According to Euromonitor, wages for manufacturing jobs in China tripled between 2005 and 2016, and will approach $6.60 an hour by 2020, according to data from Statista. That still compares favorably to the average of $36 an hour in the U.S., but labor cost is only one element of the onshore-offshore decision process. Rising Chinese wages, long distances from end-markets, high transportation costs, and more recently social, environmental, privacy, and political concerns have encouraged a re-evaluation of U.S. to China outsourced manufacturing and supply sourcing decisions. In a survey conducted by the American Chamber of Commerce in China in the spring of 2018, 35% of the respondents said that they had moved, or considered moving, their production bases out of China. In a subsequent Reuters survey of the same organization, conducted in the fall, in the midst of the trade dispute, 64% of respondents stated they were considering relocating production lines.

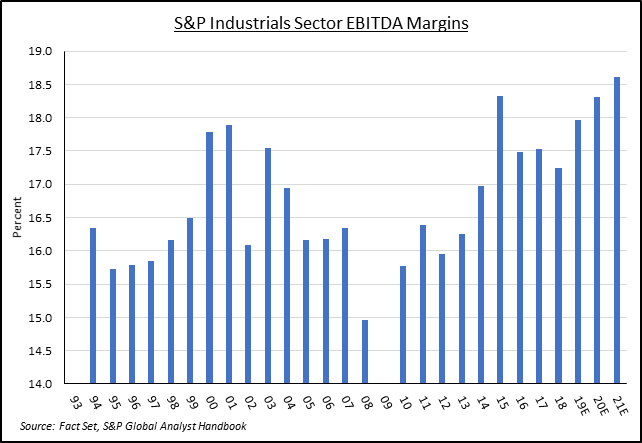

To be sure, the U.S. will not be the sole and immediate beneficiary of manufacturing “de-coupling” from the China industrial complex. Companies that choose to relocate face a long and complex process, and those that are successful will have many relocation options from which to choose. But the U.S., which has been undergoing its own industrial and manufacturing renaissance, catalyzed by the evolution of low-cost energy production and availability, is poised to gain its fair share of global industrial growth and new opportunities created by “reshoring” initiatives. Low cost energy, advanced transportation infrastructure, favorable demographic trends, proximity to the largest consumer market in the world, and competitive corporate tax rates, have all contributed to making the U.S. a more competitive manufacturing base than in the past thirty years. Automation, robotics, and 3-D printing are allowing U.S. manufacturers to further exploit those advantages. Pew Research estimates that the hourly cost of an industrial robot is $4.00 per hour, with other analysts estimating the cost at closer to $1.00, essentially negating the labor cost advantage of overseas manufacturers. While trailing Asia and Europe in robotics utilization, the U.S. is starting to pick up the pace. According to data provided by Statista, the installed base of U.S. industrial robots grew by 22% between 2016 and 2018 and is expected to accelerate between 2019 and 2025. A McKinsey Global Institute study published in 2018 suggests that the United States could boost annual value-added manufacturing by up to $500 billion (20%) over current trends by 2025. U.S. manufacturers that are early adopters in automation, robotics, 3-D printing, and artificial intelligence are poised to lead the next phase of the American Manufacturing Renaissance. While industrial stocks tend to lack attractive characteristics late in economic cycles, particularly when economic growth is slowing, select opportunities exist for investors to own tomorrow’s U.S. industrial and manufacturing leaders at reasonable prices.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.