- April 23, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C. J. Lawrence Weekly – Innovation at a Reasonable Price…IRP Investing

For decades, U.S. corporate research and development (R&D) spending was dominated by automotive and pharmaceutical companies. In the 1960s and 1970s, as the big-3 auto companies became embroiled in market share wars amongst themselves, and later versus foreign auto manufacturers, research and development became a critical weapon in the battle for competitive edge. For pharmaceutical companies, the persistent threat from generics, and continued advancements in medicine and treatments by upstarts, accentuated the need for rapid and continuous innovation and development. Interestingly, in most periods, levels of R&D spending among industry competitors remained relatively even. In rapidly changing industries, company managements realized that falling behind in R&D posed potential existential threats in later years. Thus, even financially challenged corporations ramped R&D spending, sometimes as a defensive measure. In recent years, the number of companies raising the R&D bar has been climbing. In 2014 there were 52 S&P 500 companies spending over $1 billion on R&D. In 2017 there were 60 S&P companies spending more than that amount.

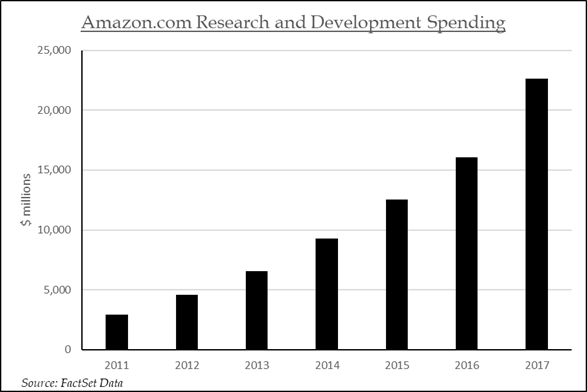

During the past few decades, technology industry participants figured prominently among the top R&D spenders. While rarely in the top spot, technology companies consistently comprised close to a third of the top twenty. In 1997 the top five U.S. corporate R&D spenders included two auto companies (GM and Ford), and three technology companies, (IBM, Hewlett Packard, and Intel). Ten years later, in 2007, the top five included two auto companies (GM and Ford), two pharmaceutical companies (Johnson and Johnson and Pfizer), and one technology company (Microsoft). But in 2017, something changed. Last year, all five of the top U.S. R&D spenders were technology companies (Amazon, Alphabet, Intel, Microsoft, and Apple). Facebook was not far behind, in the number 8 spot. We took some liberty at lumping Amazon in with technology companies given S&P categorizes it as a Consumer Discretionary company. But its massive spending initiatives have largely been in the technology arena, warranting inclusion in that bucket, in our view. Interestingly, not only have the upper echelon technology companies risen to the top of the R&D roster, they are extending their spending leads. Amazon, the top R&D spender in 2017, invested almost $23 billion in research and development in that year alone. That is more than 3x the amount of the tenth largest corporate R&D spender, Pfizer!

Amazon.com Research and Development Spending

A challenge for investors is figuring out how to incorporate R&D spending into stock valuations, as not all projects and initiatives bear fruit. But what’s clear is that most of the companies at the top of the list have high conversion rates in turning R&D spending into profitable businesses, and in widening competitive moats. In past cycles, it was not uncommon for investors to pay 40x, 50x, or 60x future earnings for the stocks of cutting edge, innovative companies. In today’s market, investors don’t need to climb as far out on the valuation curve to purchase innovation. Companies like Alphabet, Microsoft, Facebook, Apple, and Intel all trade near or below the market multiple, while delivering a mix of core earnings growth and industry leading innovation. Amazon is a bit tougher to assign a specific valuation given its penchant for capital reinvestment at the expense of earnings per share growth. But the company’s rapid revenue growth is testament to its true earning power, in our view. While the current news cycle focuses on issues like whether Alphabet will meet quarterly earnings expectations, or if Facebook will be singled out by governing bodies for privacy regulation, or if a feared slowdown in communications chip sales will slow Intel’s earnings reacceleration, long-term growth investors should not lose sight of the prize. Alphabet and Microsoft are close to breakthroughs in Quantum computing, according to a recent article in the Financial Times. Intel is extending its lead in autonomous vehicle technology through its acquisition of Mobileye. Facebook is leading the charge in artificial intelligence technology, and Amazon is charting a new course in robotics. These are the types of investments and innovation that differentiate leaders. In this cycle, innovation can be purchased at a reasonable price (IRP).

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.