- December 26, 2018

- Blog , The Trusted Navigator - Bernhard Koepp

The Grinch that Stole Christmas – C.J. Lawrence Special Market Commentary – 12/26/18 by Bernhard Koepp

A perfect storm of policy missteps is to blame for the current 20% market correction off the October high. The main culprits are:

- Unresolved trade dispute with China

- Fed Tightening/Miscommunication

- Government shutdown over border wall

- Trump cabinet resignations

- Treasury miscommunication re banks’ liquidity

- Brexit uncertainty

The market has now priced in zero earnings growth for the S&P500 for 2019 and market optimism among the general public has evaporated. Most economists, led by top ranked Ed Hyman at EvercoreISI are now using below 2% GDP growth for 2019, which suggests 5-6% earnings growth using 2011, 2012, and 2016 as a guidepost, when GDP growth was on average 1.7%, as he points out.

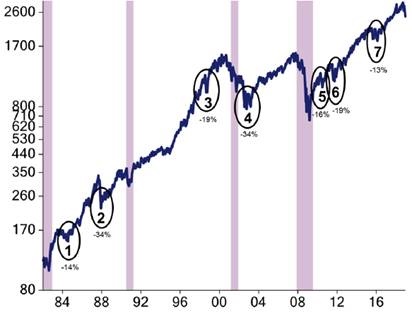

A resolution of any or all the issues listed above are needed as a catalyst for the markets to resume its uptrend in 2019. It is our belief that some these policy uncertainties are transient and may set up an interesting risk/rewards scenario for the coming year given that the current selloff was not induced by a worry about an imminent recession. Looking at each of the 7 selloffs without recessions since 1984, see chart below, all ended with the central bank easing and a favorable environment for stock returns. We are therefore not ready to call this a bear market for stocks.

S&P 500 Selloffs 1980 to Present | Source: EvercoreISI

BK

12/26/2018

Bernhard Koepp is CEO and Portfolio Manager at C.J. Lawrence. Contact him at bkoepp@cjlawrence.com or by telephone at 212-888-6342.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.