- March 5, 2022

- Blog , The Trusted Navigator - Bernhard Koepp

Market Impact & Implications of Ukraine War – Part IV

This post was originally written on March 4, 2022, 6:20 PM EST.

Stagflation remains the key market risk as the Ukraine war enters week 2. Stagflation, which is defined as stagnant demand combined with rising inflation and high unemployment, was the low probabiltiy scenario going into 2022. (We remind our investors that during times of stagflation, not much works including cash.)

The Ukraine war has clearly changed the market’s perception, but stagflation is still a lower probability in our opinion, given the strength in employment we saw in the data this morning for example: The US economy added a very strong 678,000 jobs in February (consensus was 400K!) and hourly earnings were flat, pointing potentially to some relief from the wage/price spiral. This resulted in a decrease in the unemployment rate to a very low 3.8%. So far, so good!

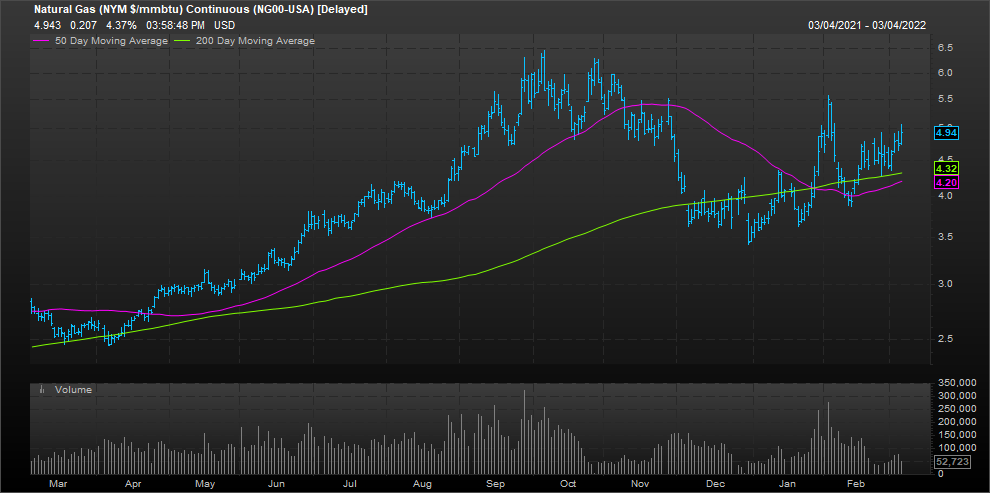

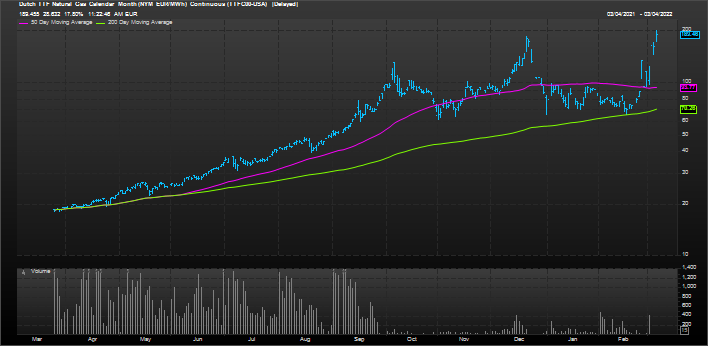

The fact that we are now looking at a more drawn-out conflict in the Ukraine, inflation pressures may persist. We are seeing the impact on supply chains, global money flows, and commodities not limited to oil and gas, but also wheat and corn. Did we know that Ukraine is the bread-basket of Europe? Not really. These intense commodity price pressures are already slowing economic activity throughout Europe. In terms of stocks, the biggest hit is to the financial sector, with European bank stocks bearing the brunt of selling pressure. The US economy so far remains largely isolated from these shocks, given our abundance of oil and gas supplies. North American oil and gas prices are also rising (see charts below), but comparing domestic natural gas prices to spot prices in Europe, the Europeans need to pay 7 times more than the US equivalent! That differential may rise even further in the coming weeks.

What are we watching?

- On the fundamental level, our portfolio companies are still reporting very robust earnings and revenue growth but many have joined a list of companies boycotting the Russian market and have withdrawn as local producers or JV partners. The financial impact is hard to quantify at the moment, but should remain small.

- On the macro level, there is a concern that the events in the Ukraine could push the European economies back into a recession. That is also a great concern for the Chinese, who depend heavily on European trade (about 1/3 of total). According to political analysts, this may be one of the reasons why China could play an important role in a brokered peace between the Russians and what is left of the Ukraine.

- We heard from the Fed’s Jerome Powell this week who indicated the Fed would perhaps only do 0.25% when it raises interest rate at its next meeting. The market rallied on the news but given the strength of the US economy and the high level of inflation, this reluctance to move aggressively to reestablish a real rate of interest, should be seen as a negative longer term.

- Brent Crude Oil went up 18% for the week to close at $118 per barrel. The previous high was in July of 2008 at $145. We may get to those levels again.

- Credit (especially higher yielding bonds) remains under pressure. For equities to bounce, we need credit to bounce also. Treasury yields ended the week lower at 1.73% for the 10yr, pointing to further flight to safety.

- Market technicals? The market (S&P500) was down ‘only’ 1.3% for the week. The Tech heavy Nasdaq was down less at -0.7%. In the coming week we will be looking for signs of stability among financials stocks which are key to any market recovery. For the year, the S&P500 is down 9.2%. The VIX (volatility index) closed at 32 today, which is still well within the range of normal. During periods of severe financial stress, this index typically goes 3x higher. Last time this happened was during the great recession of 2008 and the onset of the Pandemic in March of 2020.

We remain patient regarding portfolio positioning. Reacting to extreme geopolitical events is usually not a good strategy given how quickly markets tend to discount these events. We remain confident our portfolio companies can ride through the current storm.

Bernhard Koepp is CEO and Portfolio Manager at C.J. Lawrence. Contact him a bkoepp@cjlawrence.com by telephone at 212-888-6342.