- October 21, 2017

- Blog , The Trusted Navigator - Bernhard Koepp

Embracing Market Volatility – Can You Stomach 20% Annual Market Volatility? You should…

As we reflect on the 30th anniversary of the 1987 crash in the context of an 8-year bull market for stocks, it is worth highlighting that investing based on traditional measures of volatility, like the CBOE VIX index, are not always a good indicator of future market returns. There has been a lot of commentary about the VIX trading at low levels not seen since 2004 or the early 1990s. In previous periods these unusually low periods of volatility as measured by VIX, were in fact followed by very robust market returns. It is unclear if the same holds to be true for today’s market.

As we reflect on the 30th anniversary of the 1987 crash in the context of an 8-year bull market for stocks, it is worth highlighting that investing based on traditional measures of volatility, like the CBOE VIX index, are not always a good indicator of future market returns. There has been a lot of commentary about the VIX trading at low levels not seen since 2004 or the early 1990s. In previous periods these unusually low periods of volatility as measured by VIX, were in fact followed by very robust market returns. It is unclear if the same holds to be true for today’s market.

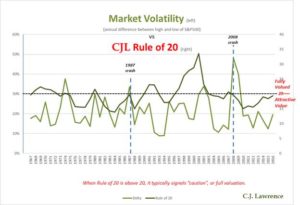

Perhaps a better way to look at market volatility in the equities’ market is to simply divide the high and the low of the market index (S&P500) annually. This year this difference is 13%. Since 1967 you get an average percentage of 21% on average since 1967. Jim Moltz, C.J. Lawrence’s Chairman and my mentor for the past 25 years, suggests that equity investors should be willing to stomach at least 20% annual volatility if they are allocating into stocks regardless of valuation or market timing. Are you ready for that?

It is interesting to note that since 1967 there were only 6 years where the percentage between high and low was above 30%, the most recent two events were in 2008 and 2009, 48% and 40%, before that in 2001 and 2002, 30% and 34%, and prior to that you have to go all the way back to 1980 when it was 30% and 1974 when it was 38%. These volatility spikes were often signaling to adverse macro conditions or recessions.

If you look to the chart above, when paired with CJL’s Rule of 20 (a measure of the market attractiveness based on adding the market P/E with CPI), market volatility stays in a predictably range between 10% and 30% and tells you very little about how attractive the market is, in other words, there is a low correlation between the market’s valuation and volatility even when accounting for inflation. This means that every investor should be willing to embrace at least 20% annual volatility if allocated into stocks. It is actually quite the norm!

Sources: High-Low data for S&P500 index from Standard & Poor’s handbook. Rule of 20 data from C.J. Lawrence.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.