- June 17, 2022

- Blog , The Trusted Navigator - Bernhard Koepp

Central Banks Find Inflation Fighting Mojo – C.J. Lawrence Market Commentary – June 17, 2022

This post was originally written on June 17, 2022, 12:39 PM EST.

There may be a silver lining to this week’s market selloff, Central Banks have found their inflation-fighting mojo again! The week started with a carefully placed leak from our Federal Reserve that a 50-basis-point increase (50 bps=0.5%) may not be enough given the higher-than-expected inflation data released last Friday.

Markets on Wednesday rejoiced with a nice broad-based rally once the Fed confirmed the 75bps raise to the Fed Funds rate at its regular meeting. Fed Funds now stand at 1.50-1.75%. Even the Swiss National Banksurprised, raising rates by 50bp, a first in 15 years, lifting negative rates from -0.75% to -0.25%.

The all-mighty Bank of England also flexed its inflation-fighting muscle showing the Continentals how it’s done, raising rates by 25bp, its fifth straight increase. Taiwan, Brazil, and Hungary all followed suit. The European Central Bank is still at Zero but has been talking more aggressively about a rate increase at its July meeting.

The debate remains: does any of this reawakening of central bank activity really matter given what we know about inflation which is quite different from the one we experienced in the 1970s and 80s? The difference this time is a combination of three factors that are outside of the central banks’ control:

- Broken supply chains in the wake of the covid pandemic

- Military conflicts in regions that are strategically important for our fossil fuel and food supply

- A tariff regime the U.S. placed on nearly $400 billion of imported goods in 2018-2019. We are seeing some relief on imported goods like solar panels, but nearly all of them are still intact according to the US Chamber of Commerce as of April this year

The above factors are a reason input prices for many of the finished goods that we buy, remain elevated or even unavailable. As long as the economy is at full employment, consumers are paying these high prices. We are seeing this play out in both the technology, automotive, and food supply chains. It has become heresy to use the word ‘transient’ when describing inflation these days, but each of the 3 factors above is outside the realm of central banks and squarely with our political leaders. They are solvable, but it takes political will. Think of what effect just a ceasefire would have on the price of oil and gas or a concerted effort to lower trade barriers or accelerated initiatives enabled by technology to onshore vital portions of our archaic global supply chains. All these positive catalysts would address stubborn inflation and are not priced into the current market which is squarely focused on a recessionary scenario.

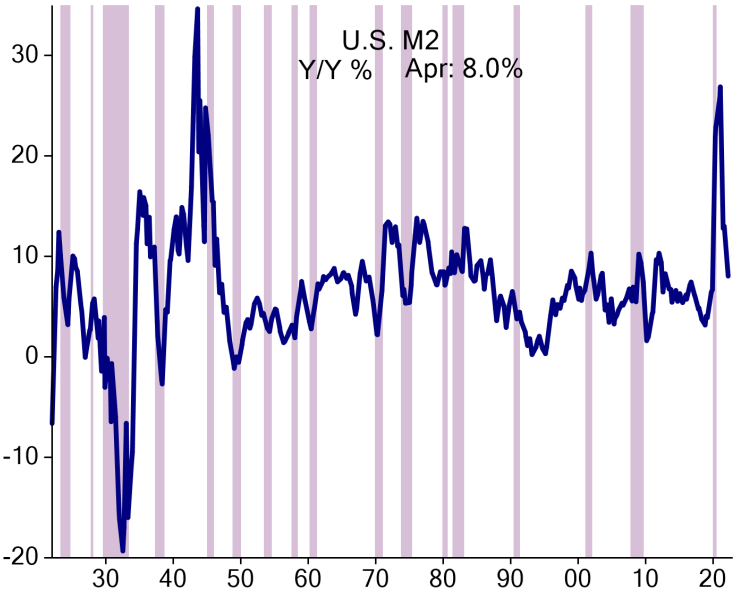

In short, central bank policy is beginning to work where it has an influence. Global short rates are back to pre-pandemic levels. US money supply growth, which traditional economists view as a major source of inflation, may turn negative y/y soon, see charts below. Housing affordability has come down given mortgage rates have doubled over the last year to above 6%. We are seeing that play out in slowing housing activity but not yet in home prices. Consumer confidence is already at an all-time low despite an economy that is still at full employment. Perhaps the meeting in Kyiv including major European leaders and President Zelensky marks the beginning of a process towards a positive catalyst. The Biden administration’s elimination of tariffs on aluminum and steel from the UK and others relating to certain imports from China is a step in the right direction to ease inflation. Finally, today the 164 members of the World Trade Organization (WTO) met to vote on a package of trade deals, including addressing food security.

Wishing all of you fathers a happy Father’s Day this holiday weekend! Markets are closed on Monday in observance of Juneteenth.

Bernhard Koepp is CEO and Portfolio Manager at C.J. Lawrence. Contact him a bkoepp@cjlawrence.com by telephone at 212-888-6342.