- March 25, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – The IPO Canary is Still Singing

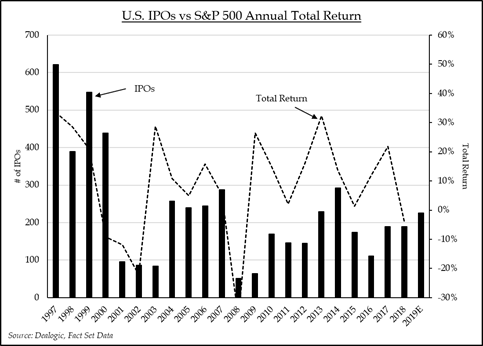

While investors were lamenting the inversion of the mid-section of the treasury yield curve late last week, traders on the floor of the NYSE were celebrating the revival of denim. The traders’ fashion statement was in honor of the return of Levi Strauss (LEVI) to the public marketplace. The company, which was founded in 1873, and was publicly traded between 1971 and 1985 before being acquired in a leveraged buy-out, is one of the high-profile new issues to hit the public marketplace this year. Ride-hailing companies Lyft and Uber are expected to make their public market debuts in the coming weeks, as are high profile sharing-economy darlings, WeWork and AirBnB. In fact, the 2019 backlog of IPOs has been growing both in terms of the total number of companies going public, and the total dollar amount of new capital expected to be raised. According to a report from Renaissance Capital, 226 private companies are now planning to list on U.S. exchanges this year. The successful float of these new issues would be a bullish sign for the stock market, as a robust IPO schedule is often a good measure of underlying market health and for investor risk appetite. Of course, conversely, the IPO tap can be turned off quickly should market conditions erode.

The past decade has not been particularly active for new issues. Low interest rates and abundant capital available to private companies, combined with the regulatory burden and high cost of being public, have discouraged management teams from pursuing the public path. In fact, the total number of publicly traded companies listed on major U.S. exchanges has fallen from close to 8,000 in 1996 to near 4,500 in 2018 as the trickle of new issues failed to keep pace with de-listings, public company combinations, and private equity take-outs. Corporate share repurchase activity has further reduced the size of the public float of available shares. We calculate that the total number of S&P 500 company common shares available to trade has fallen by 10.4% since 2011. This contraction in publicly available shares has likely been an important contributor to the bull market in stocks. Equity investors simply don’t have abundant supply from which to choose.

In frothy markets, a persistent supply of new shares can result in competition for capital, and in many cases has signaled market tops. But given the dearth of new issue activity over the past decade it is likely that this year’s introduction of new supply will be well received. Significant outflows from stock funds and into bond funds experienced during the past three years, and nine-year high cash levels in money market funds, suggest there is ample capital available for investors to deploy and/or reallocate for favored new issues. So long as the broader market remains in a welcoming mood, IPO activity should remain robust through 2019. The slowing global economy is giving stock investors plenty to worry about. But, so far, the new-issue business is flashing the “all clear” signal. The IPO “canary in the coal mine” is singing loudly. We would be wise to watch that bird for any signs of laryngitis.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.