- June 4, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Beware of the Bond Trap

Rising bond yields are often cited as an important risk to equity prices. Not only do higher interest rates render yields on fixed income instruments more competitive with stock earnings and dividend yields, but higher interest rates raise the equity risk premium that investors absorb when owning stocks. While still low by historic standards, U.S. Treasury Bond yields continue to trend higher. The U.S. 10-Year Treasury Bond yield finished last week at 2.89%, up from its one-year low of 2.05% in September of 2017. That is an 82-basis point increase, or a 40% rise in yield, from the September trough. The U.S. 10-Year Benchmark Treasury Bond yield began the year at 2.42%. But higher yields don’t always mean higher returns for investors with existing bond portfolios.

Yields on new-issue corporate bonds, priced off U.S. Treasuries, are also moving higher. But for holders of long term bonds issued prior to the 2008 financial crisis, replacing income from maturing bonds, with income from newly issued lower yielding bonds, continues to leave an income gap. In June of 2007 the yield on 10-Year Treasuries was ~5.0%, with investment grade spreads (versus Treasuries) between 50-75 basis points. Even with 100+ basis point spreads on current U.S 10-Year Treasury Bond yields of around 3.0%, most new issues lack the yield punch delivered prior to the financial crisis. The likelihood that pre-crisis yields may return is rising, but individual long-term investment grade bond holders are experiencing meaningful bond price erosion while they wait.

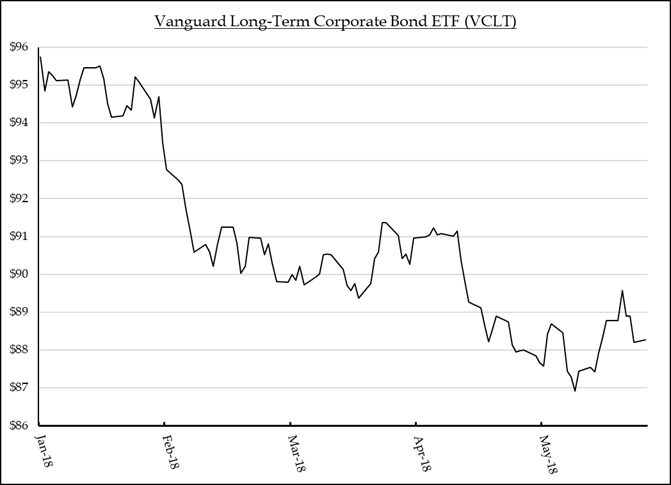

Vanguard Long-Term Corporate Bond ETF (VCLT)

The Vanguard Long-Term Corporate Bond ETF (VCLT) holds investment grade bonds with maturities greater than ten years. The fund has a yield-to-maturity of 4.2% and tracks the Bloomberg Barclays U.S. 10+ Year Corporate Bond Index. Investors find the 4+% yield attractive given the high quality of the underlying holdings and the fund’s excess yield above treasuries. But the rising interest rate environment has not been kind to the prices of the fund’s underlying bonds. As interest rates climbed, the bonds’ declining prices have more than off-set their yields, leaving the fund with a -5.7% total return year-to-date. Declining prices and a limited ability to replace higher yielding securities with equivalent yields is symptomatic of the challenges facing asset allocators in rising rate environments. Investors looking to rebalance and reallocate balanced portfolios towards bonds may instead want to consider cash or short term fixed income instruments as a rest stop while the market recalibrates prices on longer dated maturities. Yes, risks to stock prices rise with interest rates, but bonds with relatively low yields and declining prices don’t look like good total return alternatives.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.