- April 29, 2022

- Blog , The Trusted Navigator - Bernhard Koepp

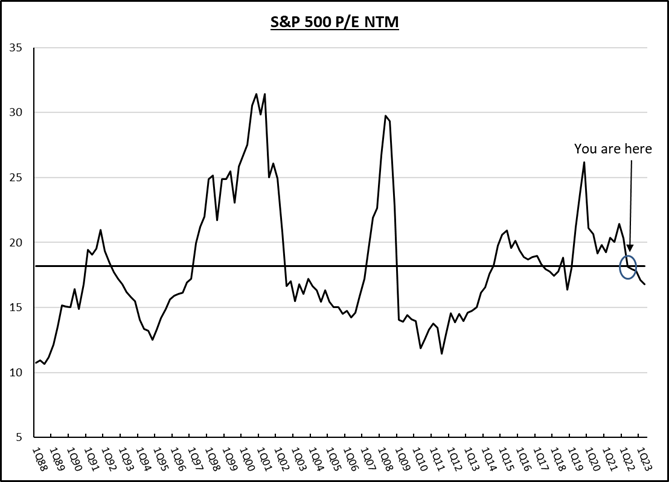

C.J. Lawrence Market Commentary – Market down 3.6% for the week, S&P500’s p/e back to historical average

This post was originally written on April 29, 2022, 5:45 PM EST.

The S&P500 was down 3.6% for the week and is retesting the lows from early March. Volatility, as measured by the VIX Index, moved above 30 again, up from 20 a month ago, which is elevated but not signaling a washout yet. The main culprit going into the week was the news out of China’s Politburo regarding its zero-tolerance approach to covid. The global economy can ill afford further supply chain disruption from the major manufacturing centers in China. There was some relief following the election outcome in France reelecting President Macron for another 5 years, insuring policy continuity within the EU regarding the war in Ukraine and an important shift in energy policies.

It was a big week for Tech earnings which gave us a good insight into the current state of the global economy. Standouts were Microsoft and Apple showing great resilience. Cloud revenues at Microsoft continue to grow at a very strong 49% but the strong dollar is weighing on international revenues. Apple showed year-on-year iPhone sales growth and margin expansion, a surprise was given supply chain headwinds.

Meta Platforms, aka Facebook, traded up 15% on its earnings. The market was relieved to see improving user engagement again, a key metric driving advertisement spending on the various social media platforms. Visa and Mastercard showed a very solid rebound in payment activity because of robust travel activity. On the chip side, Qualcomm reported strong sales and content-share gains in the newest version of Samsung phones.

The negatives were Amazon and Alphabet (aka Google). Amazon is not immune from inflationary headwinds. It is suffering from cost pressures in its eCommerce business. Prime membership is up but the fees are not enough to cover elevated shipping and wage costs.

Amazon spent the last year building out its shipping capacity to handle more volume. We’ll see if that investment pays off at its next Prime day in July. Amazon’s cloud business AWS, like Microsoft, is showing solid year-on-year growth.

Alphabet saw a slowdown in its advertisements revenues on its YouTube platform, given its move into a short form format to better compete with TikTok and Reels, which is not yet monetizing ads at the same rate as the longer format. Judging by my son’s YouTube viewing habits, I would argue that this weakness may be temporary. Alphabet also pulled YouTube from the Russian market which weighed on the quarter. That said, Alphabet is still growing revenues at 20% and generating $50 billion of free cash flow and you get all of that at a very reasonable multiple of 16x 2023 earnings per share estimate.

Today’s release of the highly elevated Employment Cost Index pushed the market to its lows into the close and sets the stage for the Federal Reserve to raise interest rates another 0.50% next week and maintain a hawkish stance regarding interest rates. In our opinion, the Fed is the main obstacle for higher equity returns near-term. In the context of growing earnings, valuations have now compressed to the historical average (see chart below of market’s price/earnings ratio since 1988), removing much of the speculative behavior we saw especially in Tech stocks during the last 2 years. The market has now corrected 13% for the year, despite rising earnings and is right at the low we saw on February 23, the eve of the Russian invasion of Ukraine. This may set up an interesting risk/reward for stocks in the second half of the year. Stay tuned!

Source: Factset & CJL

Bernhard Koepp is CEO and Portfolio Manager at C.J. Lawrence. Contact him a bkoepp@cjlawrence.com by telephone at 212-888-6342.