- June 3, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Trade Uncertainty May Challenge the Rule

Equity markets tend to thrive during periods of economic stability and visibility and struggle during times of economic and political uncertainty. Last week, as investors were grappling with the challenges associated with China-U.S. trade tensions, the Mexico tariff grenade was tossed into the tent, sending market participants scrambling to assess the potential damage of a new front in the trade war. The new tariff threats add opacity to an already murky global trade and economic growth outlook. The S&P 500 has managed to hang on to double digit year-to-date gains but is now down 5% over the past month. Equity market momentum has turned negative and the fundamental outlook is deteriorating. Demand driven declines in prices for copper, oil, and lumber are among the growing number of indicators now pointing toward slower global growth ahead. The market’s risk-off posture has pushed U.S. treasury bond prices higher and yields meaningfully lower. Sliding treasury bond yields, which had previously been viewed as a positive support for stocks are no longer viewed as bullish.

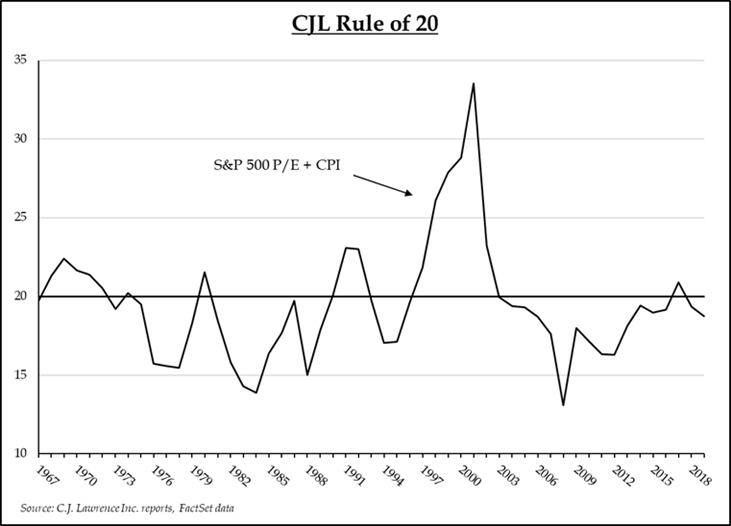

The U.S. treasury bond market may also be signaling that inflation is expected to remain subdued for the foreseeable future. In past cycles low inflation has facilitated higher price-to-earnings ratios on stocks, particularly for growth stocks. In the early 1980’s, C.J. Lawrence Investment Strategist, and our current Chairman, Jim Moltz, pioneered the CJL Rule of 20 as a measuring stick for the relationship between the market multiple (P/E) and inflation. The simple calculation behind the Rule suggests that the sum of the S&P 500 price-earnings multiple and the annual rate of inflation should equal about 20. The premise is that when inflation remains tame, the market multiple can climb and remain elevated. Using Factset’s 2019 consensus S&P 500 earnings per share forecasts of $167.36 and a 2.2% CPI estimate, puts the current reading around 18.7, slightly below the historical average, suggesting that the market is not overvalued by historic standards, when accounting for inflation.

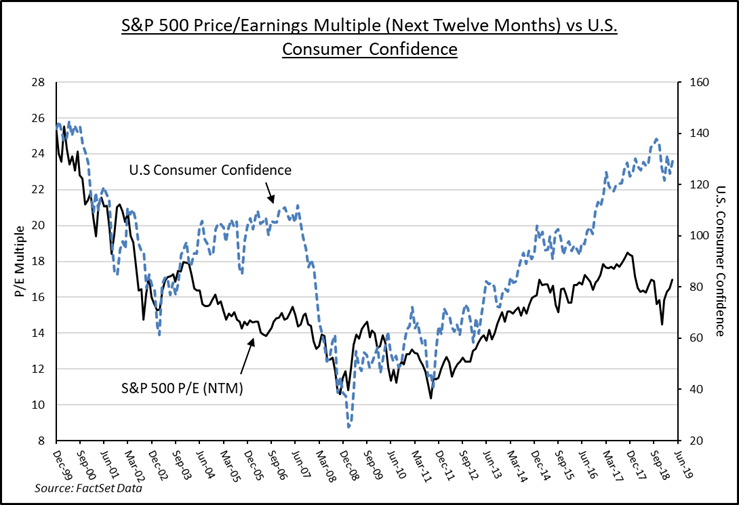

At its current level, the Rule of 20 suggests that the market multiple has room to expand. But the market multiple can also break the rule and contract during periods of uncertainty. Most recently, we saw this happen at the end of 2018 as trade tensions cropped up for the first time. Despite projected low inflation, the prospect of new tariffs and slower growth were enough to push the P/E on the S&P 500 from 16.7x down to 14.5x in a matter of two months. That 15.2% correction in the market multiple accounted for the bulk of the Index’ price decline in the quarter. Importantly the strength of the U.S. consumer bolstered confidence and spending metrics, allowing for the multiple and stock prices to recover in early 2019. To date, the U.S. consumer has been resilient and that has been good for the economy, and for the markets. But recent polls suggest that U.S. consumers are becoming increasing wary of trade wars. That development bears watching. Cracks in consumer confidence fueled by trade war concerns and uncertainty would be another weight on the back of Mr. Market, raising the odds of another stumble.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.