- February 4, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Many Will Survive but Only Few Will Thrive in a Healthy U.S. Consumer Economy

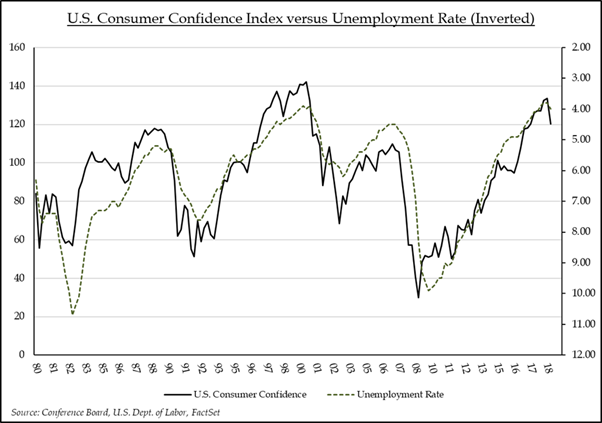

Given the sharp decline in equities during the month of December, and the negative headlines generated by the U.S. federal government shut-down, it should not have come as a surprise that the January Consumer Confidence Index reading dropped below December’s level. But the magnitude of the decline seemed to catch most consumer watchers off guard. The Conference Board report, released on Tuesday, showed that the index reading came in below even most pessimists’ expectations. At 120.2, the Consumer Confidence Index reading fell below the forecasted 124.3 expectation and was down meaningfully from the revised 128.1 result in December. While elevated by historical standards, the Index is now back to July 2017 levels. With consumer expenditures accounting for close to two-thirds of U.S. GDP, the report is watched closely by economists looking for chinks in the armor of U.S. consumption growth. But by week’s end, a robust employment report, coupled with dovish comments from Federal Reserve Board members provided some reassurance that the U.S. consumer backdrop remains healthy, and that the Fed will be hesitant to apply the brakes without clear signs of over-heating growth and inflation. Meanwhile, despite a small uptick from the last reading, the current unemployment rate of 4.0% remains a solid underpinning for the U.S. consumer economy and has historically correlated with sustained high levels of confidence and consumption.

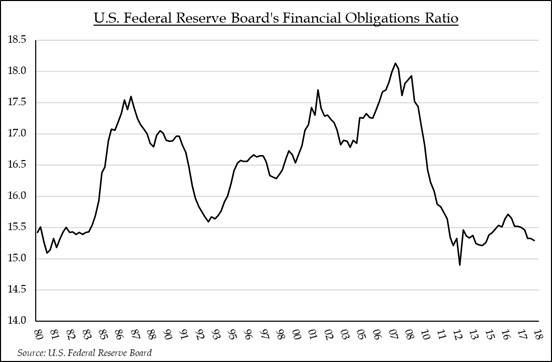

To some, increased consumption and related consumer borrowing is viewed as a growing risk to the current economic expansion. In fact, the total amount of consumer debt on U.S. household balance sheets was over $13.5 trillion and rising at the end of 3Q18, more than 21% higher than the peak reached in 2008 at the emergence of the financial crisis. But when incorporating rising household incomes, the debt picture is much more favorable. In 2003 the Federal Reserve began releasing its Financial Obligations Ratio (FOR) which captures the share of household after-tax income that is obligated to debt repayment (including mortgages, home equity lines of credit, auto loan payments, and credit card interest), including interest and principal re-payment obligations. The latest reading of 15.3 for 3Q18 remains close to a 40-year low, suggesting that consumers may have learned their lessons from the 2008 financial crisis and are living within their means. That is good news for the economy and for select consumer related stocks.

As fears of slowing economic growth permeated the market in the fourth quarter of 2018, consumer discretionary stocks took a drubbing. The Consumer Discretionary Sector Index was down 16.7% during that period. But many of the sector’s sub-groups have come out of the gate strong in 2019. Autos and Auto Parts are up 15% and 21% respectively, year-to date, versus the S&P 500 Index which is up 8.1%. The Household Durables, Leisure Products, and Luxury Goods groups have also delivered double-digit price gains so far this year. In 2018 the Consumer Discretionary Sector Index outperformed the broader S&P 500 by 580 basis points, on the back of Amazon’s 28% price gain. It may demonstrate staying power again in 2019 supported by a healthy domestic consumer economy. But the supportive backdrop may not be enough to spread the benefits across all industry constituents. In the increasingly competitive battlefield for consumer attention, companies with meaningful domestic sales exposure that can exploit cost advantages, innovate, and grow market share will be the likely winners.

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.