- March 4, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Low Interest Rates Add Fuel to the Stock Market Recovery

Interest rates at the long end of the yield curve staged a minor rally at the end of last week, surprising many who were calibrating weaker global economic data into global growth forecasts. Early in the week, reports from China showed that Chinese factory activity contracted to a three-year low and that China’s export orders fell at their fastest pace since the global financial crisis. That data fueled speculation that the world’s second largest economy is cooling faster than consensus expectations suggest. The China data added confirmation to the thesis we outlined two weeks ago in our weekly commentary that a meaningful decline in global dry bulk freighter demand, and the late year 2018 slowdown in international air cargo traffic, were flashing global growth warning signs. Both metrics are closely tied to Chinese manufacturing activity and provide a window into global trade.

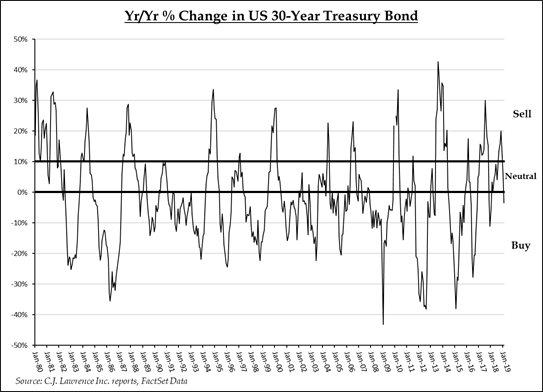

At home, the Institute for Supply Management reported last week that the ISM Manufacturing Index slipped to 54.2 from 56.6 in the prior month, the lowest reading for the Index since November of 2016. Declines in new orders, production, employment, and prices all contributed to the decline. Meanwhile, reports from the Midwest were mixed, with the Chicago Fed National Activity Index dropping to its lowest level since 2Q17, and the Chicago Purchasing Managers Index surging 8 points from the previous month. On the consumer front, the University of Michigan’s consumer sentiment index rose from the government shutdown-impacted January reading, but fell below most economists’ consensus expectations. A sampling of prominent economic forecasters appears to be split between those who believe the economy will reaccelerate later this year and those who believe slowing growth abroad will build a speedbump in the path of U.S. GDP growth for the foreseeable future. The bond market has been digesting the data and looks to be voting with the slow growth camp. In fact, the long bond component model of our CJL Market Monitor moved to a bullish (on equities) position at the end of February, based on lower year-over-year long bond yield comparisons. That is a rare occurrence late in an economic cycle.

Source: C.J. Lawrence Inc. Reports, FactSet Data

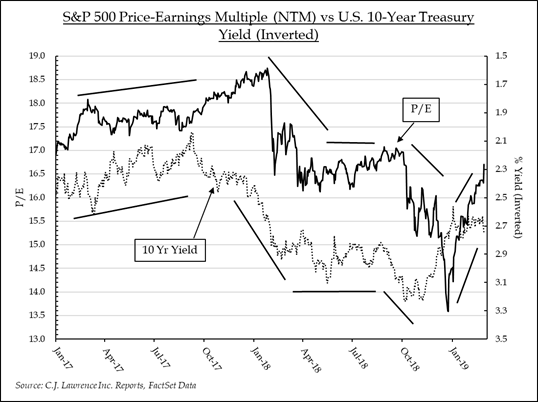

For stock investors, low rates are a welcome market backdrop, and have helped stocks recover from their December lows. Of course, favorable headlines regarding a pending trade deal between the U.S. and China have helped boost market sentiment, but the fundamental underpinning of low interest rates has supported market multiple expansion that has led to 19% price appreciation for the Index since late December. During this period the price-earnings multiple of the S&P 500, based on 2019 EPS estimates, climbed from 13.9x, at the December lows, to its current 16.7x level. The 20% rise in the P/E multiple helped offset a 3% decline in 2019 earnings forecasts since December (numbers may not add perfectly due to rounding and timing). Our CJL Rule of 20, which posits that adding the current year P/E on the S&P 500 to the annual rate of inflation should approximate 20, leaves a little room for further multiple expansion. But for the market to stage a meaningful rally from current levels either a further decline in interest rates or a recovery in earnings growth, or both, would need to be ingredients. Based on recent economic data, neither looks likely, putting added emphasis on security selection to achieve outperformance.

Source: C.J. Lawrence Inc. Reports, FactSet Data

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.