- March 23, 2018

- Blog , The Trusted Navigator - Bernhard Koepp

Where to Hide In A Stormy Environment?

As we recover from the 4th snow storm in the North East, markets this week succumbed to its own perfect storm. Five factors brought down the market this week:

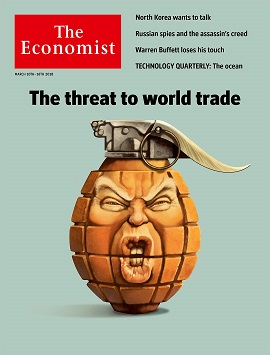

The Economist Cover March 10-16, 2018

First, there was some concern about this week’s Fed meeting and how the new Fed Chair Powell would perform in his first live press conference. The Fed raised rates by 25bps, which was the consensus, but the market was a bit surprised by the committees more hawkish outlook.

Second, a more subtle factor this week was the disappointing earnings release by General Mills (GIS), a major food company, taking its stock down 12% on the day. General Mills Management announced it is seeing cost pressure from rising input prices and indicated it would need to raise prices to sustain existing margins. Why is this important? Much of the Bull/Bear debate these days can be divided into 2 camps: The one believes inflation is in check and there are sufficient secular forces at work globally to keep it (and interest rates) in check; the other believes inflationary forces are brewing and will spill over from the famous “ex Food and Energy” to the core CPI, which includes labor and services. The General Mills’ report gave the “inflation is in check” crowd a cause for concern.

Third, weak data out of Europe: the all-important Ifo data which measures German business confidence came in weaker yesterday based on “concerns about protectionism” according to Ifo’s chief economist. This was a shot across the bow for those who believe global growth a key support for the domestic economy.

Fourth, LIBOR is on the move. This may not be a big deal for banks with adequate liquidity, but it is weighing on weaker banks especially in Europe which are still vulnerable to liquidity shocks.

Fifth and the final factor which broke the market’s back somewhere mid-week, was a combination of new punitive tariffs (see this week’s Economist cover which captures the market’s emotion well) announced by the Trump administration to punish the Chinese for “steeling our technologies”. This comes in the middle of an already tense Technology sector in the wake of the unfolding Facebook scandal. Tech is one of the key pillars of the current bull market and driver of our economy. Its absence would certainly call into question the sustainability and duration of the current bull cycle and our economic outlook which remains constructive. As of this writing both Facebook and Google, the digital advertisement duopoly controlling just under 60% of the total domestic digital ad spend, are now down for the year after hitting a high up 10% and 12% respectively at the end of January.

In short, rising trade wars or reciprocal tariffs regardless of what sector they effect, if implemented, make whatever they target more expensive. This adds fuel to the idea that we need to be positioned for inflation down the road.

Technicals & market bottoms: we are not technicians but our friends at Strategas Research note that the volume on the current decline was a lot less than what we saw in February when the volatility index (VIX) also spiked much higher. Looking at market internals, there is still sufficient breadth to suggest that we are not at a top of the market like in 2000 or 2007. On the sector level some of the more cyclical sectors like semiconductors, homebuilders and trucking are still acting well relative to the market, which gives us some comfort that the market is not signaling a cyclical downturn. The S&P500 has traded back to its 200-day moving average, and is still in an uptrend. It is our expectation the market should find some support here.

What are we buying in this environment? When inflation rises it is very important to own stocks of companies that have pricing power and take market share. Distinguishing between just shifting from Growth to Value or Value to Growth is really not the right way to look at portfolio strategy, in our opinion. The attributes of pricing power and market share dominance can be found in both traditional Growth and Value sectors which we incorporate into all of our portfolios. At C.J. Lawrence we have called this investment approach Bulldog-investing. Bulldogs are companies with exceptional competitive advantages and dominant market share positions in promising sectors. Jim Moltz, our Chairman, taught us some 25 years ago that a consistent application of this strategy combined with the patience to keep portfolio turnover low, produces good portfolio outcomes for our clients over time. The current environment is no exception.

BK

03/23/18

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.