- May 28, 2019

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Trade Stand-Off May Lead to Long Term Gain, Short Term Pain. Overweight Communications Services

U.S. – China trade talks, or the lack thereof, continue to dominate business news headlines and are creating an overhang on stock prices. Investors hope that the overhang will be lifted soon, but both the U.S. and China look to be digging in for a protracted battle. President Trump said last week that he thought a deal could get done, but then during his recent visit to Japan stated that “the U.S. is not ready to make a deal”, based on the current status of negotiations. In a commentary over the weekend, the Chinese state news agency Xinhua, stated that U.S. pressure on China to curb the influence of state-owned enterprises was a threat to China’s economic sovereignty. Some of the rhetoric may be posturing, but the public positions do not sound like two parties who are moving closer to a deal. Meanwhile in the U.S. there is bipartisan support for taking a hard line with China. It may be the only issue on which President Trump and Senator Chuck Schumer agree!

We’ve written previously about the longer-term impact of the trade war on sourcing and manufacturing decisions, and our belief that one of the stand-off outcomes will be the re-shoring of manufacturing capacity back to the U.S. over the next several years. But in the meantime, the global economy may suffer some dislocation while two of the world’s most influential economic powers reset trade relationships. The OECD is now forecasting that US GDP growth will slow by 0.1 percentage point to 2.8% this year and slip to 2.3% next year as a result of reduced trade. Chinese GDP growth is expected to slow to 6.2% in 2019 and slow further, to 6.0%, over the next two years. The current tariff regime, and prospects of new ones, appears to be taking hold in both the U.S. and China. Last week’s US durable goods report showed that April orders came in flat with last year’s level and were down 2.1% including autos and aircraft. In China, food prices jumped 6.1% in April due to higher pork and fruit prices, with pork price increases accelerating to 14.4% from 5.1% in March. Last week, Beijing set up a special task force, the State Council Employment Work Leading Group, to monitor the country’s employment situation. The move underscores the government’s increasing concern that trade related unemployment is on the rise in the wake of recent high-profile layoffs by Sony Mobile, Cisco Systems and Oracle.

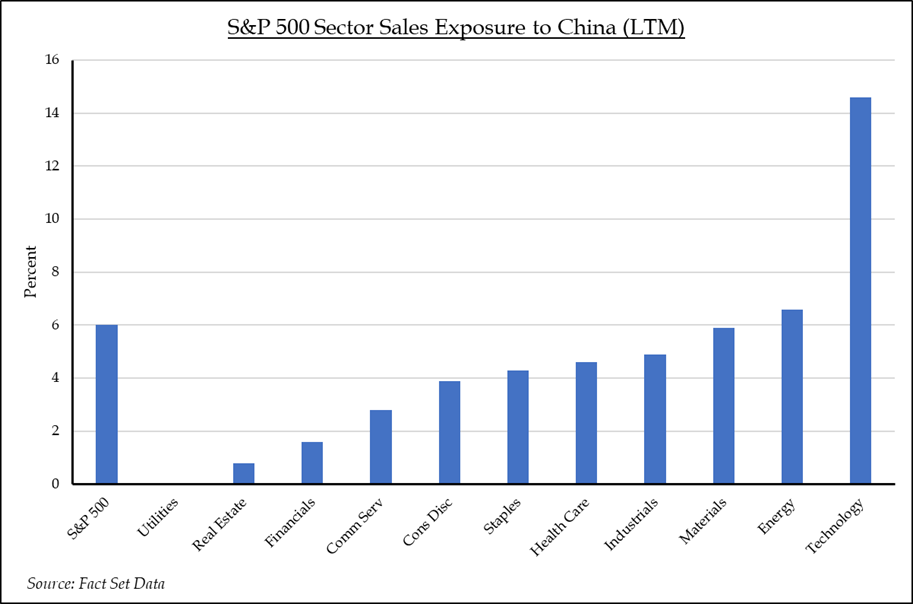

US stocks have languished during the past few weeks as headlines have dominated price momentum. The S&P 500 is up 13.7% year-to-date, but the index has given back 3.9% over the past month. As expected, the laggards are in the sectors most exposed to China and the global economy. The Energy, Materials, and Technology sectors are down 7.0%, 6.4%, and 6.9% respectively in the past month. Meanwhile leadership has come from the Real Estate, Utilities, and Health Care sectors, due to their defensive characteristics, and in the cases of Real Estate and Utilities, purely domestic sales exposure. Select groups within the Consumer Discretionary sector may possess some of the same characteristics and warrant investor attention. But perhaps the best combined offensive and defensive plays can be found in the Communications Services sector which has a broad mix of telecom, traditional media, social media, and gaming constituents. The sector has only 2.8% China sales exposure and is coming off several years of heavy capital and research and development spending that has depressed margins in 2019 but is likely to help accelerate growth in 2020 and 2021. Data from Factset shows that the sector’s earnings per share are expected to grow 12% in 2020 and 12% again in 2021. That is attractive growth in any market. Perhaps China’s recent stiff-arm of Alphabet and Facebook was a good thing!

Terry Gardner Jr. is Portfolio Strategist and Investment Advisor at C.J. Lawrence. Contact him at tgardner@cjlawrence.com or by telephone at 212-888-6403.