- June 11, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C.J. Lawrence Weekly – Support for Consumer Discretionary Stocks…U.S. Household Net Worth Exceeds $100 Trillion for First Time

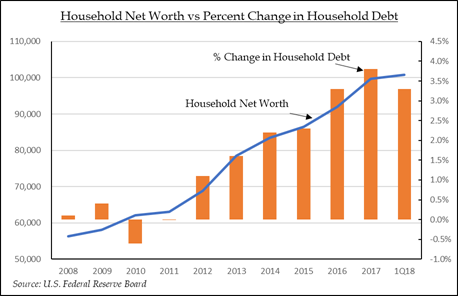

It’s not surprising that U.S. Consumer Confidence is high. U.S. household net worth eclipsed $100 trillion for the first time in 1Q18, according to the Federal Reserve Board’s quarterly Flow of Funds report. The two categories that have the greatest impact on household balance sheets are property values and the value of households’ direct and indirect equity holdings. In 1Q18 the value of real estate held by households increased by $0.5 trillion, while the value of directly and indirectly held corporate equities declined $0.4 trillion. Data from the recent S&P/Case-Shiller Home Price Indices suggests no let-up is in sight for rising home prices and values. Meanwhile, negative returns on corporate equities, which off-set some of the improvement in real estate values in the first quarter, will likely be a tailwind in the second quarter report, with the S&P 500 Index already up 5.2% quarter-to-date.

Household Net Worth vs Percent Change in Household Debt

According to the report, U.S. household debt rose at a 3.3% annual rate in 1Q18. That compares to household net worth growth of 7.0% from the year-ago period, resulting in improving household debt-equity ratios. Consumer credit grew at an annual rate of 4.2%, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.9%. Interestingly, U.S. households were sellers of corporate equities and buyers of U.S. Treasury securities in the quarter, which may reflect reactions to lower stock prices and continued rebalancing of household portfolios that had breached equity asset allocation targets due to rising stock prices.

U.S. Consumer Confidence

The Fed’s recent snapshot paints a picture of a healthy U.S. household sector. That is good news for U.S. Gross Domestic Product (GDP), two-thirds of which is driven by consumer spending. But while some market watchers suggest that the U.S. economy is late in the business cycle, U.S. households have not levered up to the extent they have at the end of past cycles, raising the prospect that this cycle could last longer than consensus forecasts. In fact, by the Fed’s measures, U.S. household balance sheets continue to improve. Of course, the Fed’s report does not categorize different segments of the population, some of which may not be experiencing the same improvement. But the aggregate data is supportive of a growing consumer economy and consumer segment health. Meanwhile, the S&P Consumer Discretionary Sector Index is up 12% year-to-date, outpacing the S&P 500 by over 700 basis points. The backdrop remains constructive for continued outperformance.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.