- April 30, 2018

- Blog , The Portfolio Strategist - Terry Gardner

C. J. Lawrence Weekly – Rising Rates Provide Headwind, not Barrier, for Stocks

Last week’s market action was noteworthy for its flowing cross-currents. Economic and corporate earnings reports were particularly strong, but for bulls, the equity market’s reaction was disappointing. The S&P 500 Index finished the week close to flat, versus the prior week’s close. Market watchers were confounded by Tuesday’s 1.3% decline, which coincided with strong corporate earnings releases. In fact, of the 54% of Index constituents that have reported 1Q18 results to date, 80% have delivered earnings per share that exceeded analysts’ expectations. That is remarkable progress! The Index is now on track to deliver 23% year-over-year earnings growth for the quarter. We estimate that the new corporate tax rates may account for ~7% of the improvement, suggesting ~16% growth, pre-tax benefit. Either way, the reported, and forecasted, results represent a meaningful improvement from last year’s level, and a significant uptick in growth forecasts from the beginning of the year. In January, analysts were expecting 10.7% 1Q earnings-per-share growth.

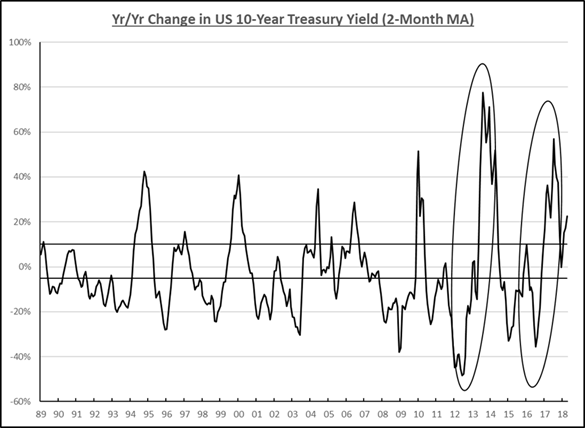

The economic data released last week painted a similarly rosy picture. Existing and new home sales, consumer sentiment, and 1Q18 GDP all came in ahead of expectations. Bond yields rose on the back of the reports, causing the U.S. 10-Year Treasury Bond Yield to pierce the psychologically important 3.0% mark. The rise in long rates may be encouraging a shift in target asset allocations in favor of bonds versus equities. The recent fund flow figures from Investment Company Institute confirm that the growing enthusiasm for equity funds, experienced at the beginning of the year, has flamed out. In fact, for the week ending 4/18, taxable bond funds saw net inflows of $9.3 billion, while domestic equity funds realized $2.4 billion of redemptions. This trend is likely to continue in the coming weeks as the Federal Reserve stays on track with its rate normalization plan, and heavy issuance from the U.S. Treasury keeps upward pressure on yields.

Full Disclosure: Nothing on this site should be considered advice, research or an invitation to buy or sell securities, refer to terms and conditions page for a full disclaimer.